MANAGER’S REPORT

DYNAMIC DE-RISKING STRATEGY

2014 was a challenging year. Notwithstanding that, CIT

successfully acquired four properties, totalling S$140.8

million. As at 31 December 2014, CIT’s portfolio stood at

50 assets with a value of S$1.37 billion and occupancy

remained stable at approximately 96.0%, above the

industrial average market of 90.9%

1

The Manager continued to proactively manage

its lease expiries and improved its tenant mix to

strengthen its portfolio. During the year, the Manager

renewed 1.88 million sq ft of leases with a positive

average rental version of 4.6%. With a diversified

base of 168 tenants, the top 10 tenants accounted

for approximately 37.3% of rental income as at

31 December 2014. CIT’s Weighted Average Lease Expiry

(“WALE”) stood at 4.0 years with an average portfolio

rent of S$1.08 psf per month.

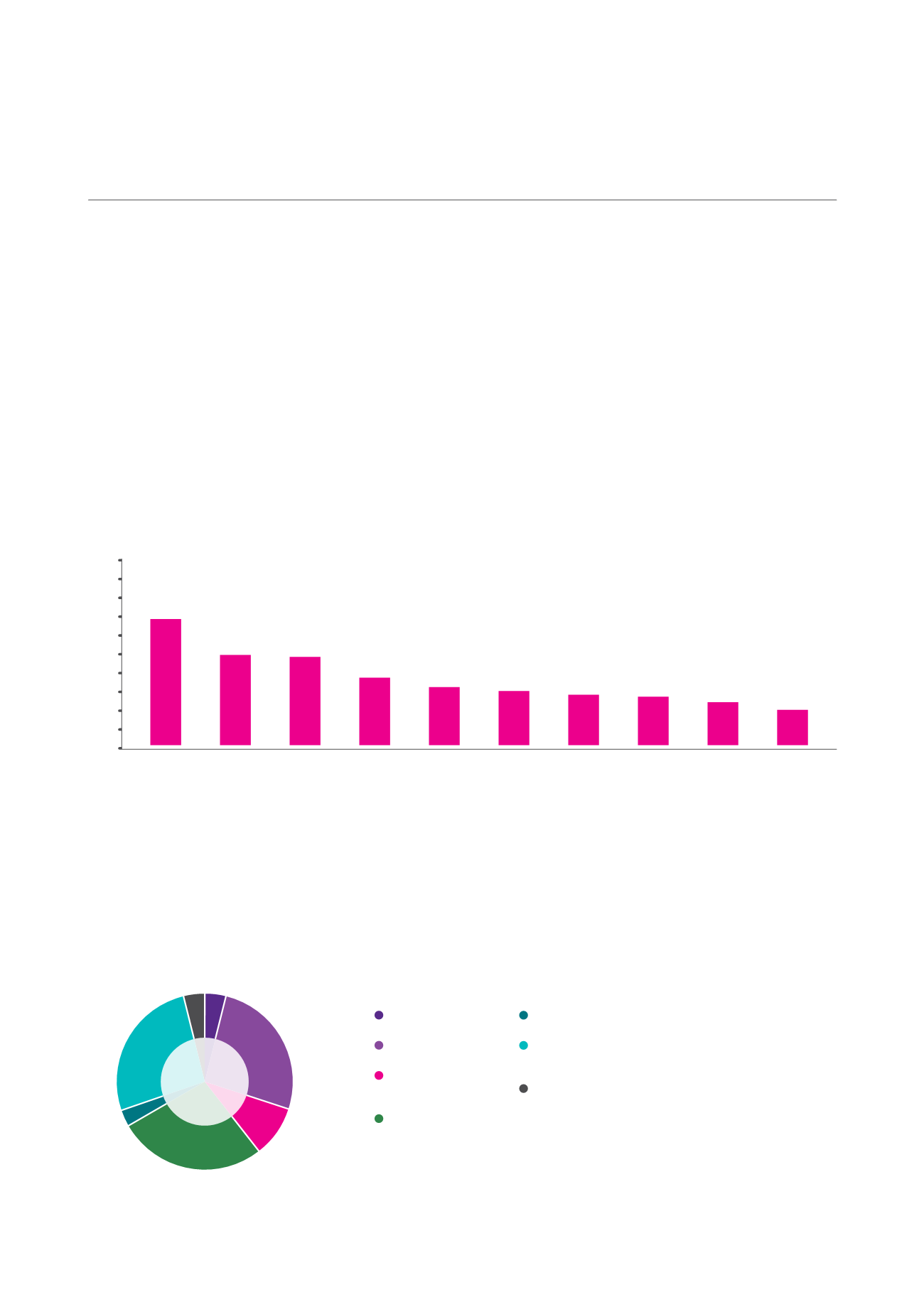

TOP 10 TENANTS ACCOUNT FOR 37.3% OF RENTAL INCOME

AS AT 31 DECEMBER 2014

6.9

5.0

4.9

3.8

3.3

3.1

2.9

2.8

2.5

2.1

Venture Corporation Limited

Nobel Design Holdings Ltd

Hoe Leong Corporation Ltd

CWT Limited

HG Metal Manufacturing Limited

EuroSports Auto Pte Ltd

Beyonics International Pte Ltd

Seksun International Pte Ltd

Tye Soon Limited

Compact Metal Industries Ltd

10.0

5.0

0.0

1.0

6.0

2.0

7.0

3.0

8.0

4.0

9.0

%

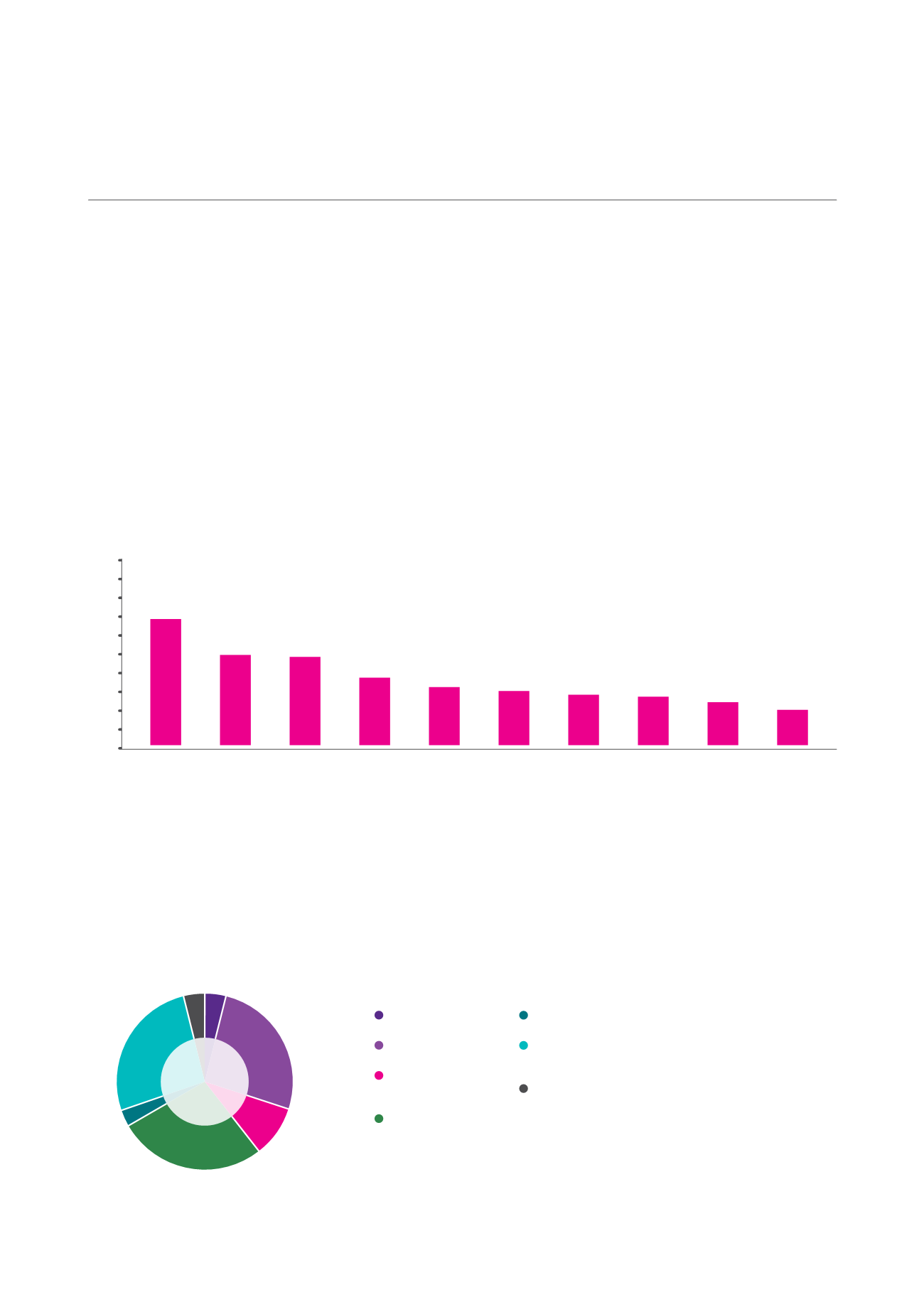

TRADE SECTOR (BY RENTAL INCOME)

AS AT 31 DECEMBER 2014

Construction

Manufacturing

Transportation

and Storage

Precision Engineering

Other Services

Wholesale, Retail Trade

Services and Others

Professional, Scientific

and Technical Activities

4.0%

26.1%

9.4%

27.3%

3.0%

26.4%

3.8%

1 JTC 4th quarter market report

CAMBRIDGE INDUSTRIAL TRUST | ANNUAL REPORT 2014

10