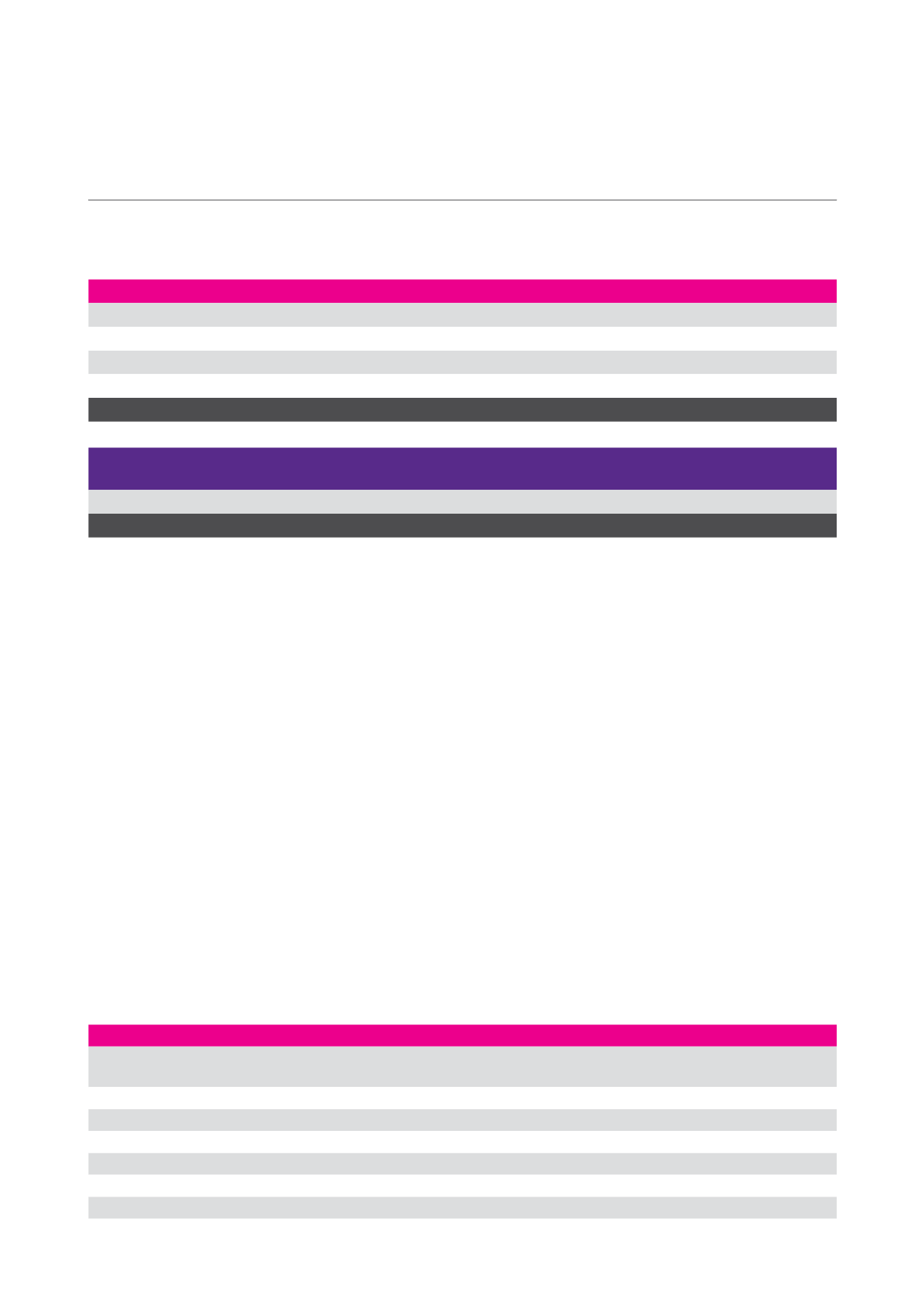

December 2014

December 2013

Total Debt (S$ million)

(excluding unamortised loan transaction costs)

480.0

362.2

Gearing Ratio (%)

34.8

28.7

All-in Cost p.a (%)

3.7

3.9

Weighted Average Debt Expiry (years)

2.2

2.6

Unencumbered Properties (S$ miilion)

407.5

354.5

Interest Rate Exposure Fixed (%)

89.6

82.8

Available Undrawn Facilities (S$ million)

90.0

77.8

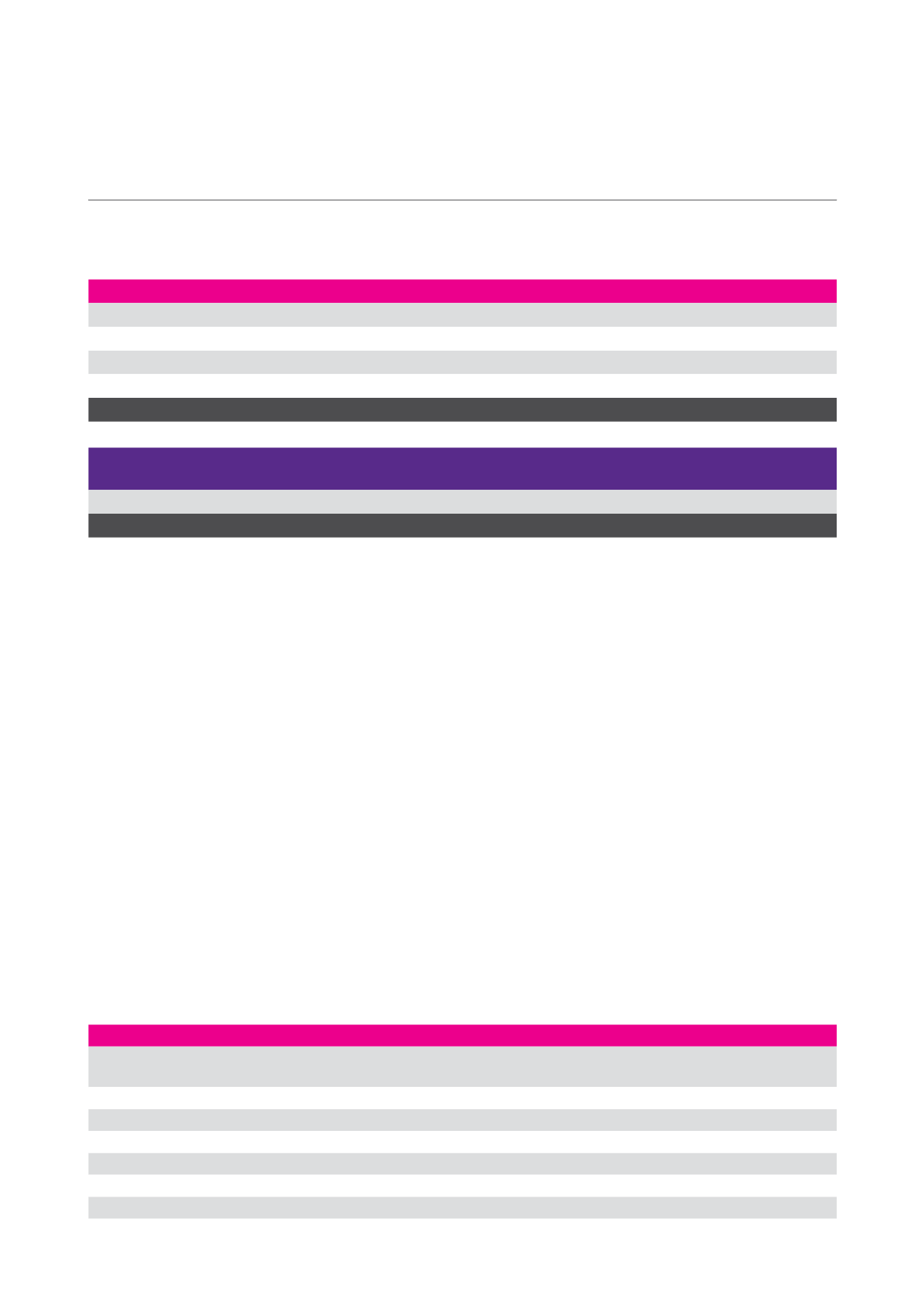

FY2014 ACQUISITIONS / DIVESTMENT SUMMARY

Acquisitions

GFA (sq ft)

Completion

Purchase Price (S$million)

16 International Business Park

~69,258

19 Dec 2014

28.0

12 Ang Mo Kio Street 65

~180,424

12 Sep 2014

39.8

11 Chang Charn Road

~97,542

31 Mar 2014

32.0

30 Teban Gardens Crescent

~139,525

17 Mar 2014

41.0

Total for 2014

~486,749

140.8

Divestments

GFA (sq ft)

Completion

Book Value

(S$ million)

Gross Proceeds

(S$ million)

Premium to

Book Value

81 Defu Lane 10 45,242

24 Mar 2014

6.7

7.8

16%

Total for 2014 45,242

6.7

7.8

PRUDENT CAPITAL AND RISK MANAGEMENT

In 2014, the Manager focused on strengthening and

increasing the flexibility of the capital structure of CIT. We

continue to exercise prudent capital management while

supporting the Trust’s growth initiatives. The Manager

reduced the dependency on secured loans and further

diversified the Trust’s debt maturity profile by issuing

Medium TermNotes (MTNs) to bond investors at attractive

pricing levels.

In line with CIT's hedging policy and in light of potential

interest rate hikes by the US Federal Reserve, the

Manager has ensured that majority of its interest rate

exposure is fixed. This provides stability on distributions

to Unitholders. The Manager will continue to monitor

the interest rate environment and employ suitable risk

management strategies to ensure Unitholders continue

to enjoy steady distributions going forward.

DISCIPLINED CAPITAL MANAGEMENT

In April 2014, we priced and issued a S$30 million 6 year

MTN, bearing a coupon yield of 4.1% p.a. The proceeds

arising from the issue were used to finance general working

capital and capital expenditure requirements of CIT. The

MTN was well-received by fixed-income investors and the

issuance was over subscribed within a short span of time.

In October 2014, we priced and issued a S$100 million 4

year MTN, bearing a coupon yield of 3.5% p.a. This was

CIT’s largest MTN issuance to-date and was well-received

by investors. The issuance was 1.7 times subscribed and

was priced attractively compared to peers. The proceeds

arising from the issue were used to retire existing revolving

credit loans and partially fund new acquisitions.

These issuances strengthened CIT's capital structure

and reduced the dependency on secured loans. The

debt maturity profile of CIT is more diversified, reducing

refinancing risks in the coming financial years.

The Manager has enhanced key capital matrices of CIT as

set out below:

CAMBRIDGE INDUSTRIAL TRUST | A WINNING FORMULA

13