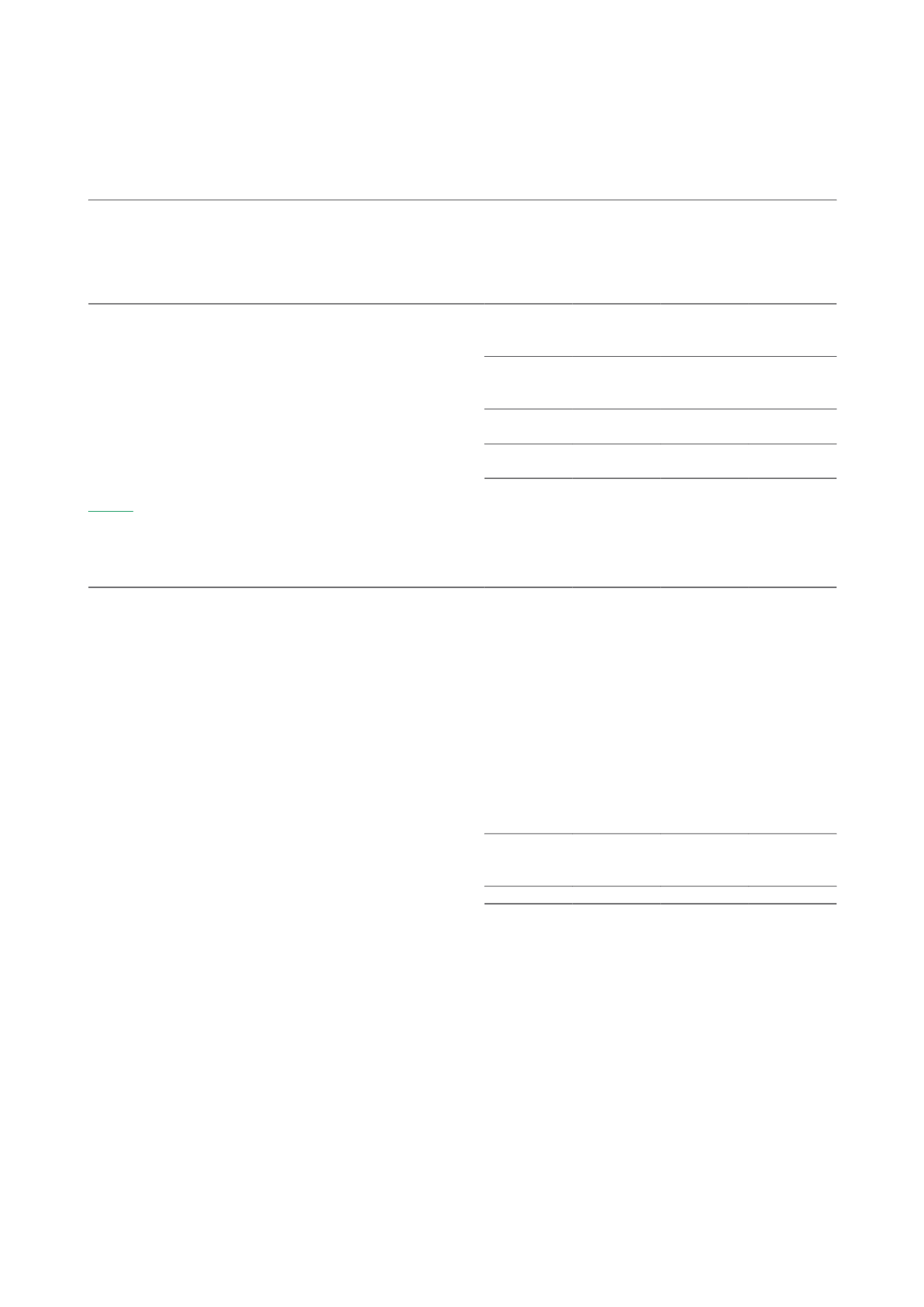

Group

Trust

2014

2013

2014

2013

$’000

$’000

$’000

$’000

Total return after income tax, before distribution for the year

45,316 118,884

45,422 105,526

Add/(less): Distribution adjustments (Note A)

12,298 (75,408)

12,192 (62,050)

Net income available for distribution to Unitholders

57,614 43,476

57,614 43,476

Distribution from capital (Note B)

1,925

13,869

1,925

13,869

Distribution from capital gains (Note B)

3,496

3,941

3,496

3,941

Total amount available for distribution

63,035

61,286

63,035

61,286

Less: Distributions (Note C)

(47,105)

(45,778)

(47,105)

(45,778)

Net amount available for distribution to Unitholders

as at 31 December

15,930

15,508

15,930

15,508

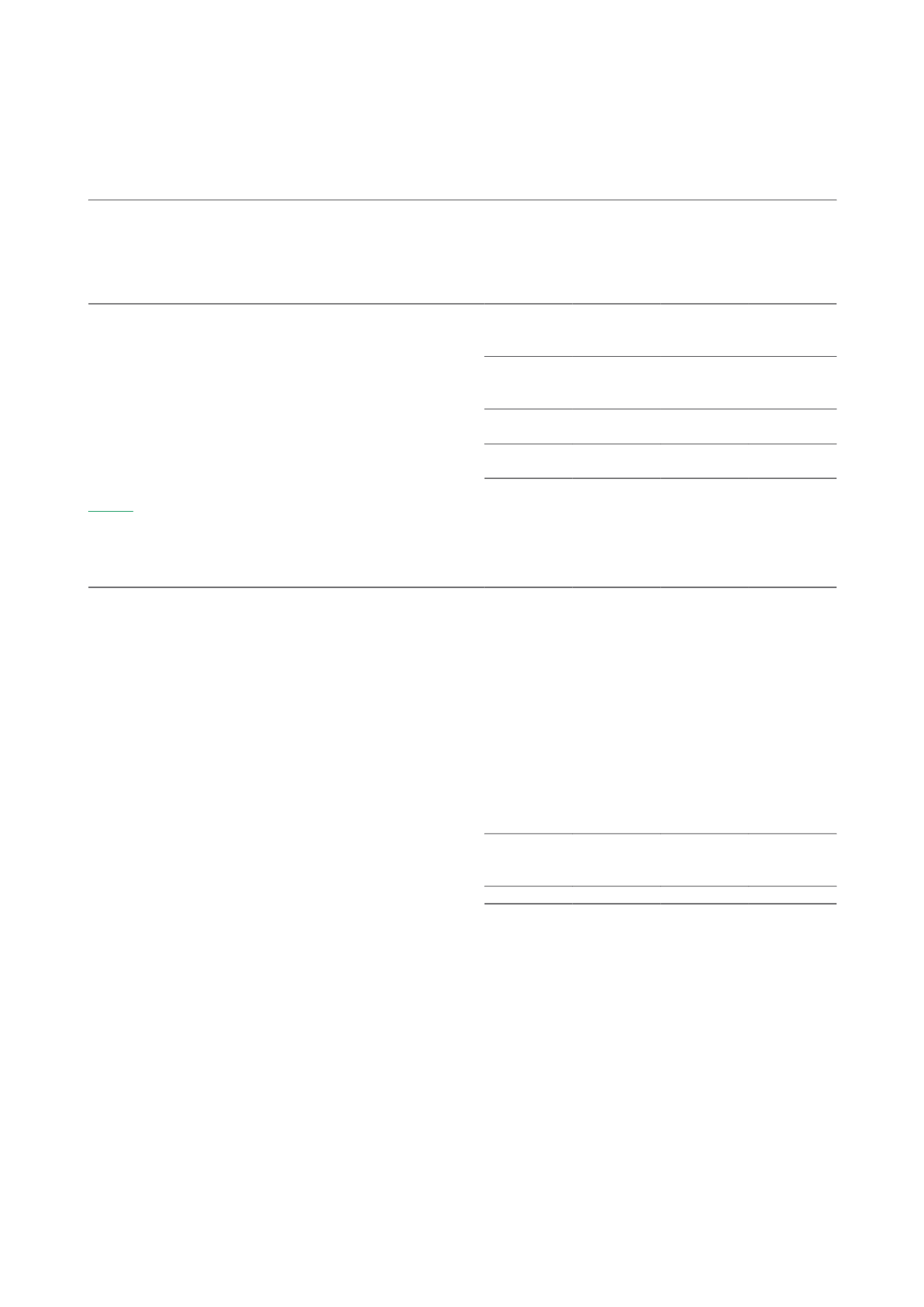

Note A – Distribution Adjustments

Group

Trust

2014

2013

2014

2013

$’000

$’000

$’000

$’000

Non-tax deductible items and other adjustments:

Management fees payable in units

2,358

–

2,358

–

Trustee’s fees

364

359

364

359

Transaction costs relating to debt facilities

4,081

9,118

4,081

9,118

Change in fair value of investment properties and

investment properties under development

7,876 (33,856)

7,876 (33,856)

Change in fair value of financial derivatives

(1,142)

(2,084)

(1,142)

(2,084)

Legal and professional fees

(57)

855

(57)

855

Adjustment for straight line rent

(1,751)

(1,556)

(1,751)

(1,556)

Share of profits in jointly-controlled entity

(496)

(13,951)

–

–

Distribution income from jointly-controlled entity

603

594

–

–

Miscellaneous expenses

312

95

313

96

Allowance for doubtful debts

1,197

–

1,197

–

13,345

(40,426)

13,239 (27,068)

Income not subject to tax:

Gain on disposal of investment properties

(1,047)

(34,982)

(1,047)

(34,982)

Net effect of distribution adjustments

12,298 (75,408)

12,192 (62,050)

DISTRIBUTION STATEMENT

YEAR ENDED 31 DECEMBER 2014

The accompanying notes form an integral part of these financial statements.

CAMBRIDGE INDUSTRIAL TRUST | A WINNING FORMULA

103