Examples of Major* Known Potential Supply of Warehouse Space from 2015 to 2018

(As of 4Q 2014)

Project Name

Location

Developer

Estimated

Net Lettable

Area (sq ft)

Expected Year

of Completion

(TOP)

Single-User Warehouse

Warehouse

Gul Circle

Crystal Freight Services

Distripark Pte Ltd

928,102

2016

Supply Chain City Jurong West Avenue 2/

Jurong West Street 23

Supply Chain City Pte Ltd

(YCH Group)

1,335,886 2016

Warehouse

Pandan Road

Poh Tiong Choon

Logistics Limited

1,038,216 2018

Multi-User Warehouse

Space @ Tampines 18 Tampines Industrial

Crescent

Oxley Bliss Pte Ltd

602,574

2015

Warehouse

5B Toh Guan Road East Mapletree Logistics Trust

Management Ltd

580,799

2016

Carros Centre

60 Jalan Lam Huat

Kranji Development

Pte Ltd

991,420

2017

* refers to projects with an estimated net lettable area of at least 500,000 sq ft

Source: JTC/Colliers International Singapore Research

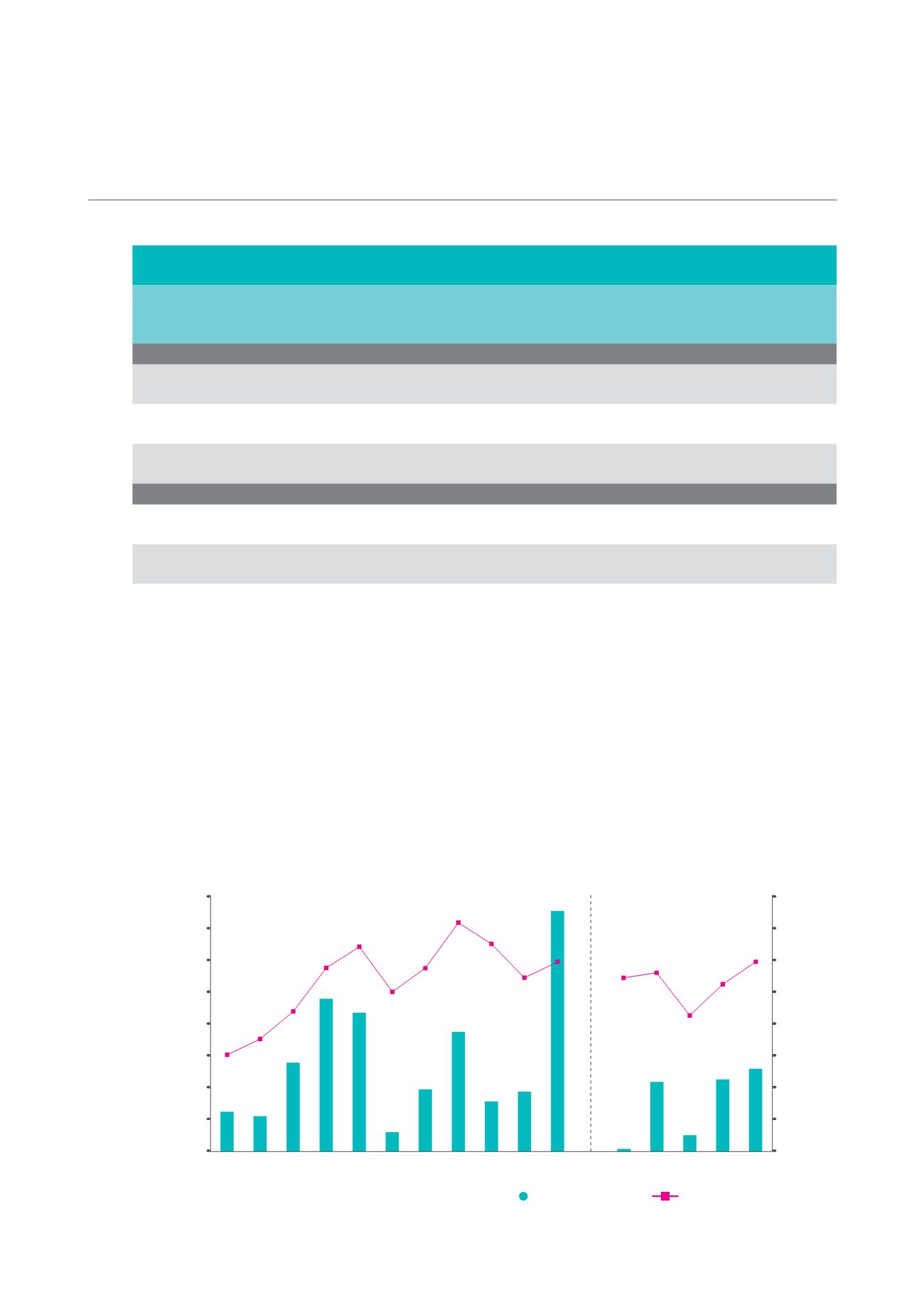

5.2 DEMAND AND OCCUPANCY

Net new demand of warehouse space surged 303.5% YoY to a historical high of 7.5 million sq ft in 2014, compared

to an average annual net new demand of 2.4 million sq ft from 2004 to 2013. As overall net absorption exceeded

the corresponding net new supply of 7.3 million sq ft in 2014, the average occupancy rate improved from 90.8%

as of 4Q 2013, to 91.8% as of 4Q 2014.

NET NEW DEMAND AND AVERAGE OCCUPANCY RATE OF WAREHOUSE SPACE

(As of 4Q 2014)

2004

2008

2006

2010

2012

2005

2009

2007

2011

2013 2014

4Q13 1Q14 2Q14 3Q14 4Q14

1,000

2,000

3,000

4,000

5,000

6,000

7,000

8,000

96%

94%

92%

90%

88%

86%

84%

82%

80%

0

Net Floor Area ('000 sq ft)

Occupancy Rate

Source: JTC/Colliers International Singapore Research

Net New Demand

Occupancy Rate

CAMBRIDGE INDUSTRIAL TRUST | A WINNING FORMULA

93