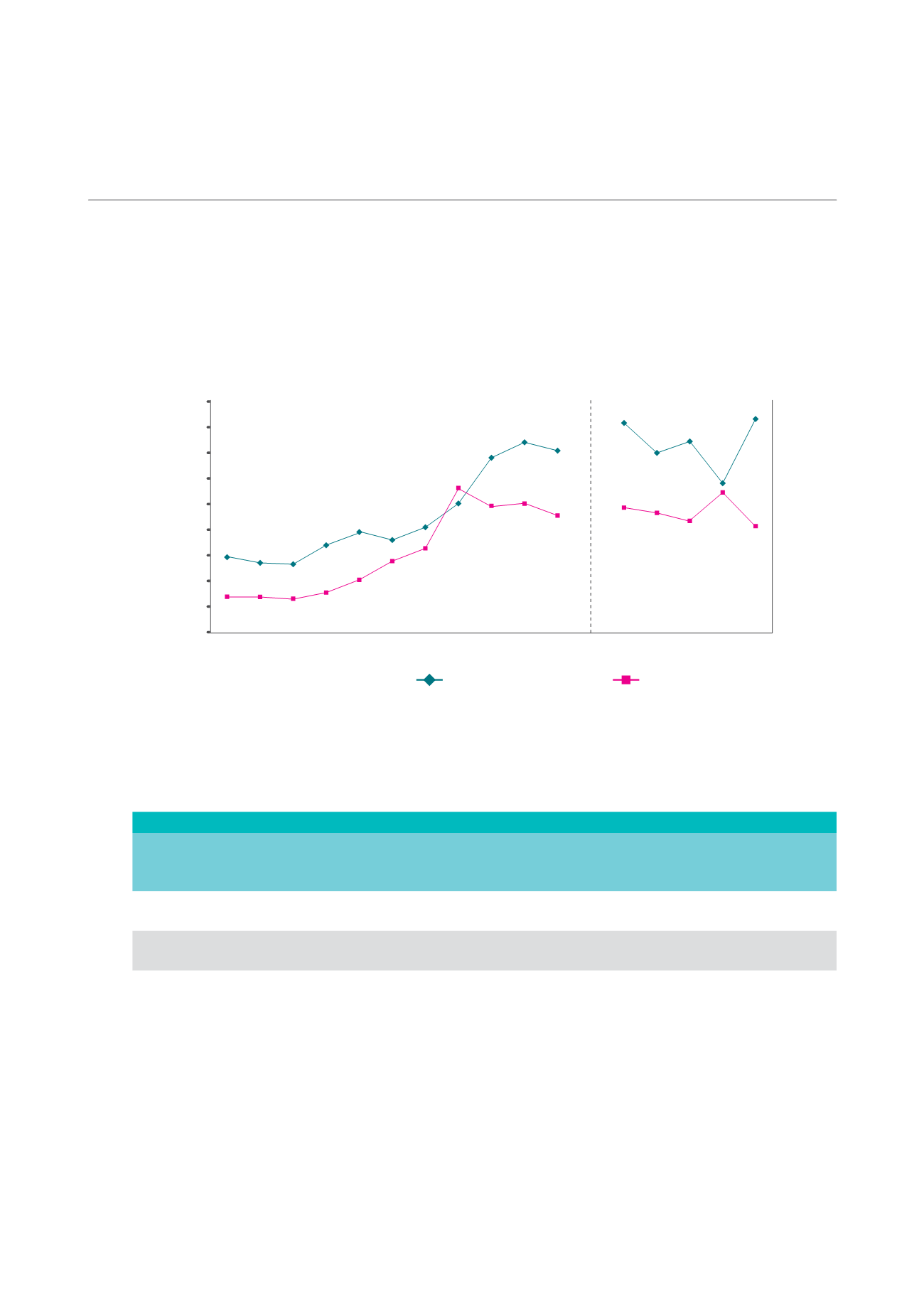

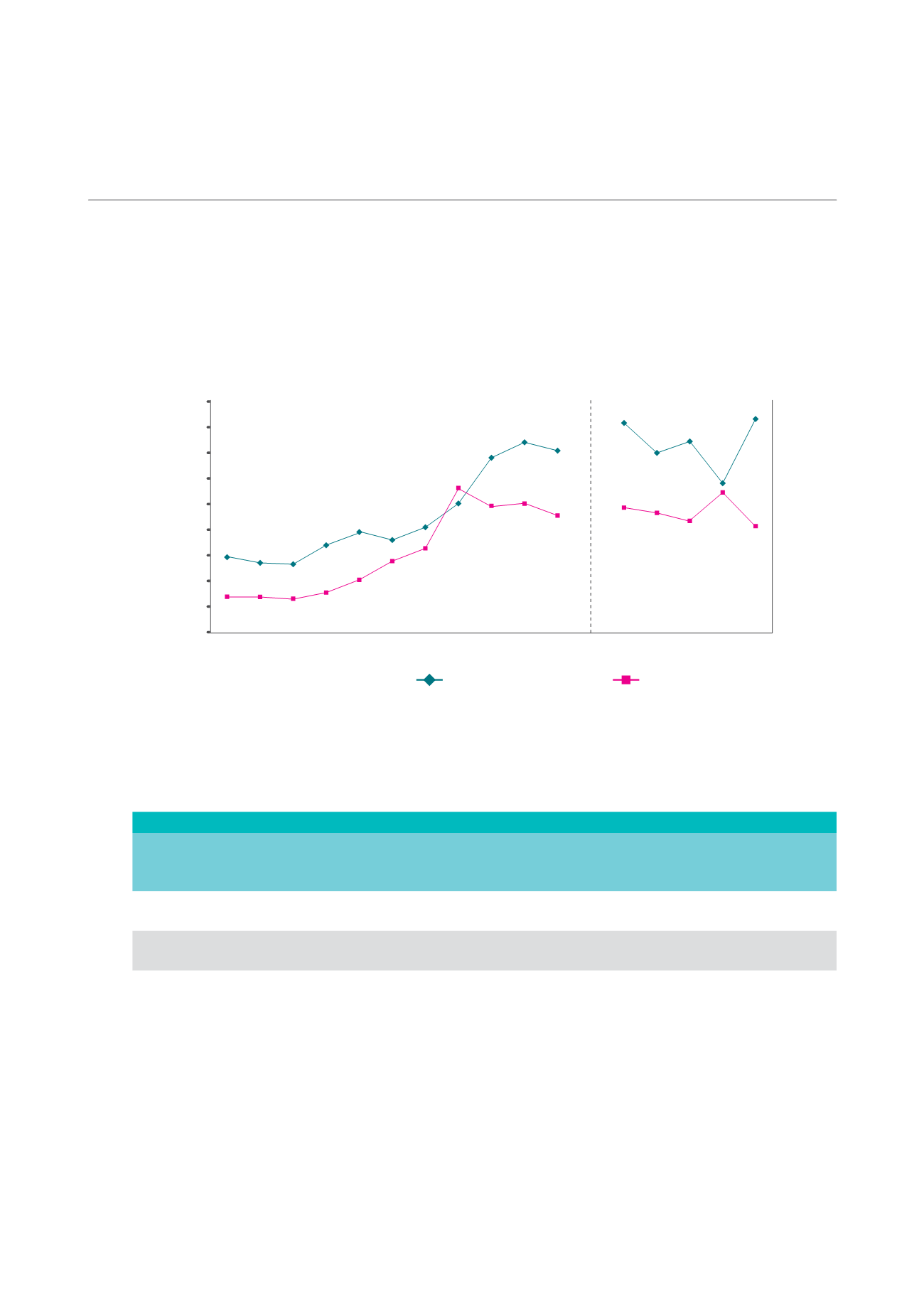

The fall in average prices of multi-user warehouse properties was in tandam with the slowdown in transaction

activity for strata-titled industrial properties in 2014, following recent Government measures such as the

implementation of a SSD on industrial properties in January 2013 and the TDSR framework in late-June 2013,

and generally subdued market sentiment.

AVERAGE PRICES* OF FREEHOLD/999-YEAR LEASEHOLD AND 30-YEAR & 60-YEAR LEASEHOLD MULTI-USER

WAREHOUSE SPACE

*Note that the average prices are dependent on the number and type of transactions that occur during the quarter/year. This in

turn depends on factors such as the location and age of the building as well as the floor level and size of the unit.

Source: URA REALIS/Colliers International Singapore Research

30-Yr & 60-Yr Leasehold

Freehold/999-Yr Leasehold

2004

2008

2006

2010

2012

2005

2009

2007

2011

2013 2014

4Q13 1Q14 2Q14 3Q14 4Q14

$0

$100

$200

$300

$400

$700

$500

$800

$600

$900

S$ per sq ft

Some examples of major warehouse investment sales in 2014 are provided in the following table.

Examples of Major Warehouse Investment Sales in 2014

Project Name

Location

Tenure

Estimated Net

Lettable Area

(sq ft)

Sale Price

(S$ million)

Price

(S$ per sq ft

over NLA)

5 Gul Lane

5 Gul Lane

30 years

w.e.f. 1 Feb 2011

125,077

(GFA)

$12.3

$98

(GFA)

1 Kallang Place 1 Kallang Place

30 years

w.e.f. 1 Dec 1994

167,253

(GFA)

$12.6

$75

(GFA)

134 Joo Seng

Road

134 Joo Seng Road 30+30 years

w.e.f. 1992

76,424

(GFA)

$13.5

$177

(GFA)

Source: Colliers International Singapore Research

5.5 OUTLOOK

Demand for warehouse space in 2015 is expected to receive continued support from Singapore’s standing as

an important logistics hub in Asia, Asia’s expanding consumer base and the growth of the e-retailing industry,

which would generate more storage, packing and distribution requirements.

With the anticipated moderation in warehouse supply in 2015, of which the majority is expected to be single-

user space and are likely to be almost fully occupied upon completion, the islandwide average occupancy rate

for warehouse space is expected to remain at a healthy level of around 90%.

CAMBRIDGE INDUSTRIAL TRUST | A WINNING FORMULA

95