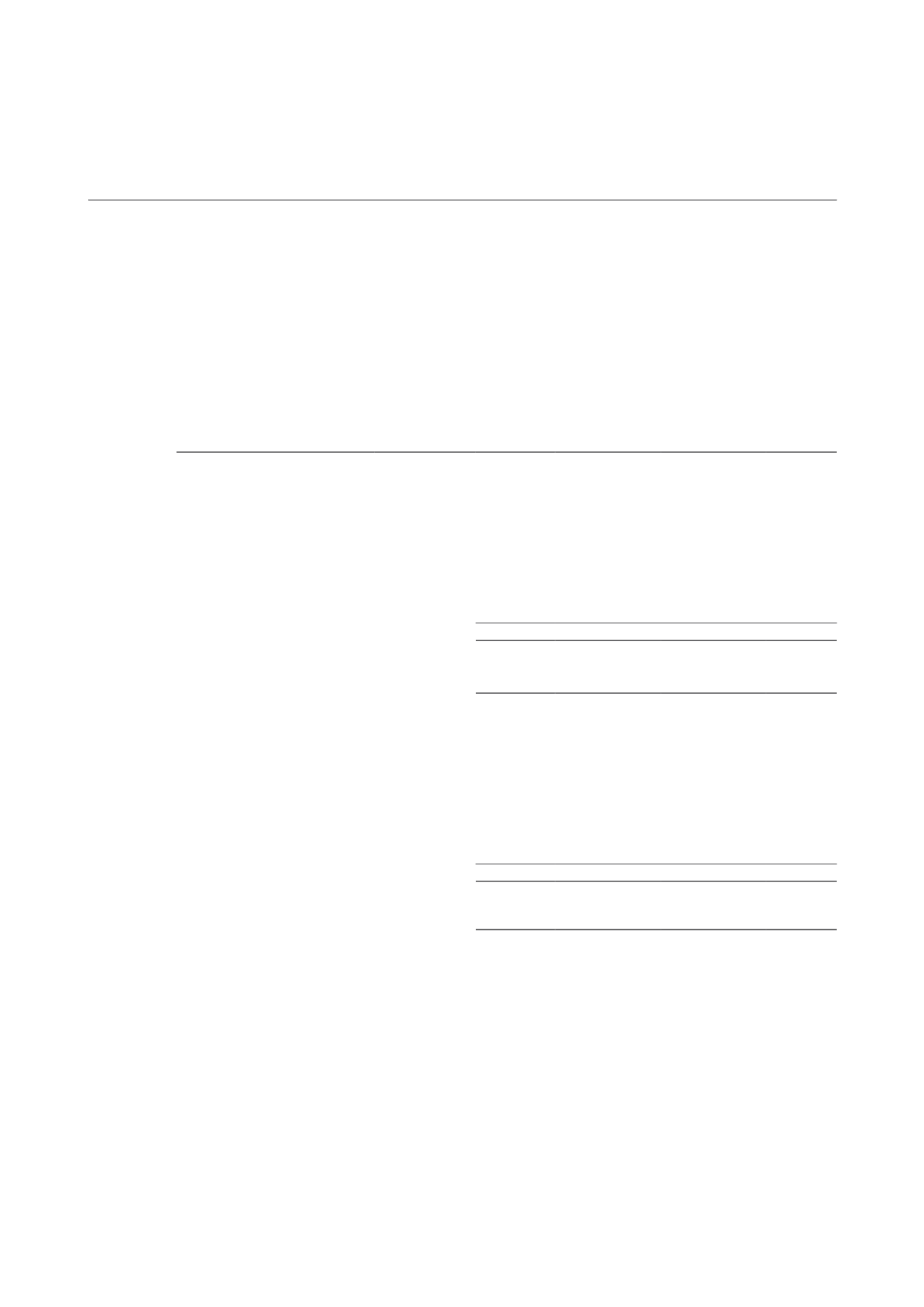

NOTES TO THE FINANCIAL STATEMENTS

25 Financial instruments (Cont’d)

Interest rate risk (Cont’d)

(a)

Effective interest rates and repricing analysis (Cont’d)

Trust

Effective

interest rate

Floating

interest

Fixed interest

rate maturing

within

1 to 5 years

Fixed interest

rate maturing

more than

5 years

Total

% $’000

$’000

$’000 $’000

2014

Financial liabilities

Interest-bearing borrowings

– S$ variable rate

2.67 200,000

–

– 200,000

– S$ variable rate

2.00 100,000

–

– 100,000

Loan from subsidiary

– S$ fixed rate

4.75

–

50,000

– 50,000

– S$ fixed rate

4.10

–

–

30,000 30,000

– S$ fixed rate

3.50

–

100,000

– 100,000

300,000

150,000

30,000 480,000

Financial assets

Derivative financial instruments

0.73

–

287

– 287

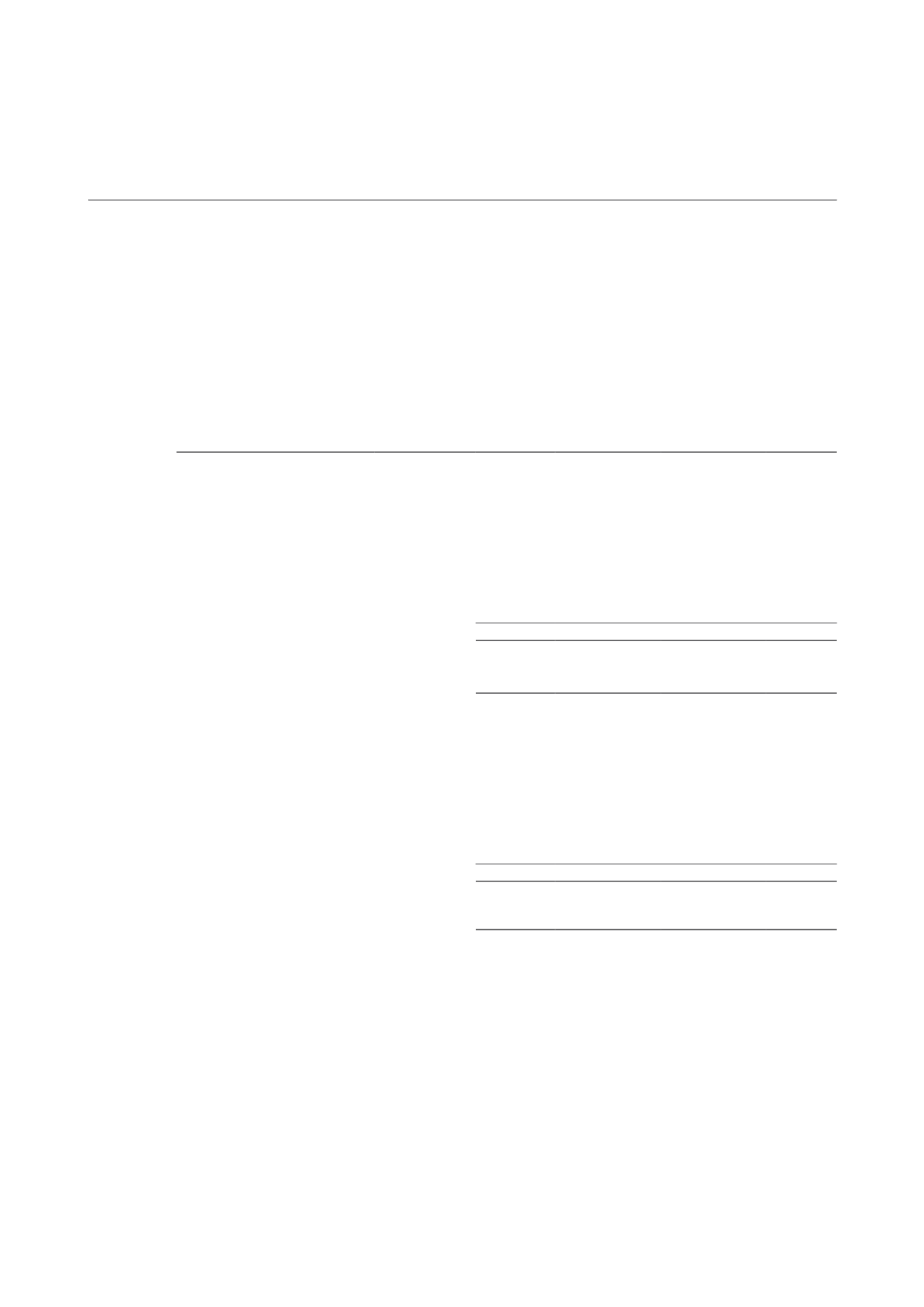

2013

Financial liabilities

Interest-bearing borrowings

– S$ variable rate

2.60 200,000

–

– 200,000

– S$ variable rate

2.57

12,172

–

– 12,172

– S$ variable rate

1.92 100,000

–

– 100,000

Loan from subsidiary

– S$ fixed rate

4.75

–

50,000

– 50,000

Derivative financial instruments

0.20

–

1,161

– 1,161

312,172

51,161

– 363,333

Financial assets

Derivative financial instruments

0.61

–

227

– 227

(b)

Sensitivity analysis

In managing the interest rate risk, the Group aims to reduce the impact of short term fluctuations on

its earnings.

Fair value sensitivity analysis for fixed rate instruments

The Group does not account for any fixed rate financial assets and liabilities at fair value through profit or

loss. Therefore, a change in interest rates at the reporting date would not affect profit or loss.

A change of 100 basis points in interest rates, if accounted for, would have increased or decreased

Unitholders’ funds and total return by approximately $0.5 million (2013: $0.7 million) for the Group and

for the Trust respectively.

CAMBRIDGE INDUSTRIAL TRUST | A WINNING FORMULA

161