NOTES TO THE FINANCIAL STATEMENTS

25 Financial instruments (Cont’d)

Credit risk (Cont’d)

Cash and fixed deposits are placed with financial institutions which are regulated.

At the reporting date, except as disclosed in Note 8, there were no significant concentrations of credit risk. The

maximum exposure to credit risk is represented by the carrying value of each financial asset on the Statement

of Financial Position.

Interest rate risk

The Group’s exposure to changes in interest rates relate primarily to its interest-bearing financial liabilities.

Interest rate risk is managed by the Manager on an ongoing basis with the primary objective of limiting the

extent to which net interest expense could be affected by adverse movements in interest rates. The Group

adopts a policy of ensuring that majority of its exposures to changes in interest rates on borrowings is on a fixed-

rate basis. This is achieved by entering into interest rate swaps and fixed rate borrowings.

(a)

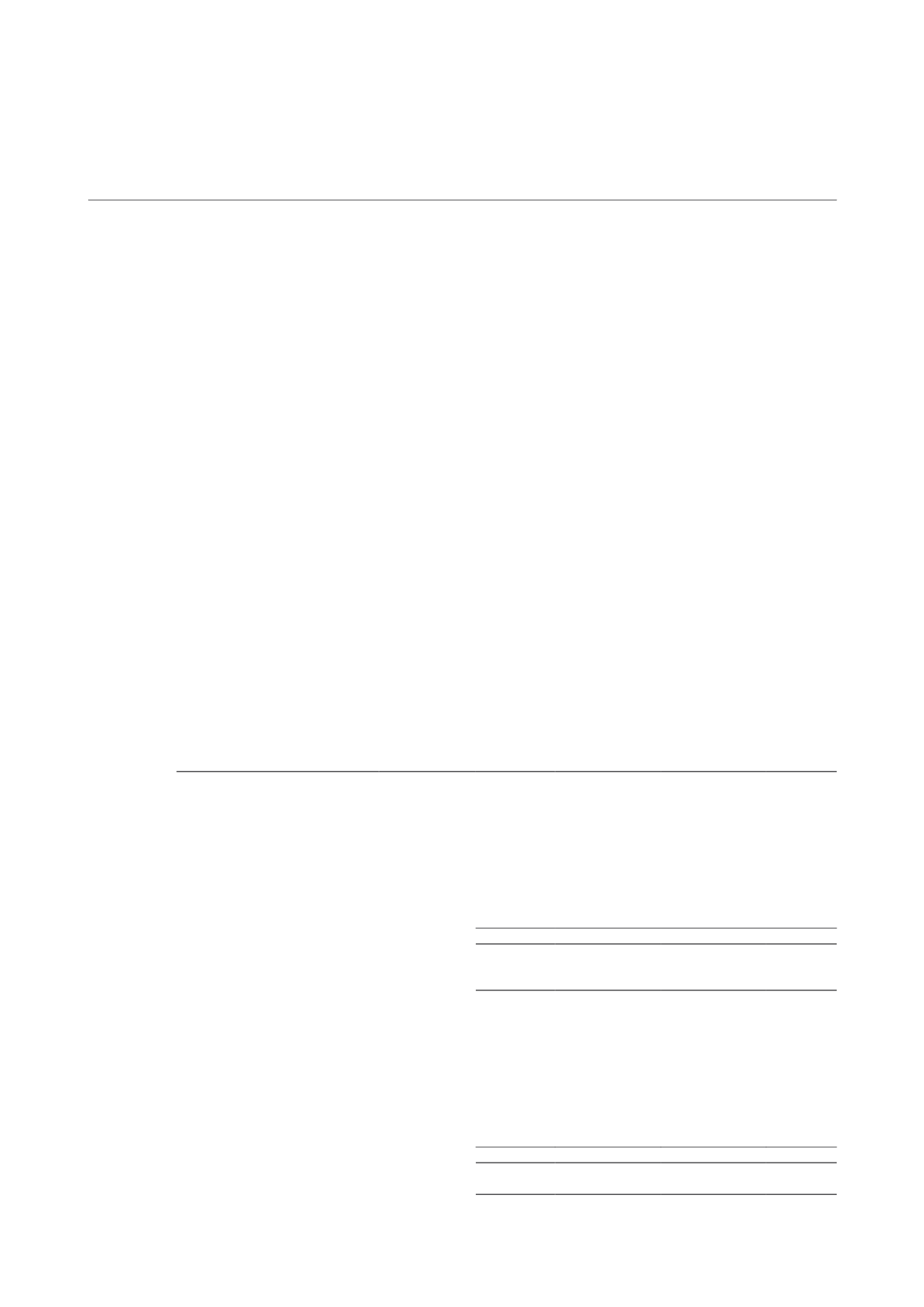

Effective interest rates and repricing analysis

In respect of interest-earning financial assets and interest-bearing financial liabilities, the following table

indicates the effective interest rates as at 31 December 2014 and 31 December 2013 and the periods at

which they reprice.

Group

Effective

interest rate

Floating

interest

Fixed interest

rate maturing

within

1 to 5 years

Fixed interest

rate maturing

more than

5 years

Total

% $’000

$’000

$’000 $’000

2014

Financial liabilities

Interest-bearing borrowings

– S$ variable rate

2.67 200,000

–

– 200,000

– S$ variable rate

2.00 100,000

–

– 100,000

Medium Term Note

– S$ fixed rate

4.75

–

50,000

– 50,000

– S$ fixed rate

4.10

–

–

30,000 30,000

– S$ fixed rate

3.50

–

100,000

– 100,000

300,000

150,000

30,000 480,000

Financial assets

Derivative financial instruments

0.73

–

287

– 287

2013

Financial liabilities

Interest-bearing borrowings

– S$ variable rate

2.60 200,000

–

– 200,000

– S$ variable rate

2.57

12,172

–

– 12,172

– S$ variable rate

1.92 100,000

–

– 100,000

Medium Term Note

– S$ fixed rate

4.75

–

50,000

– 50,000

Derivative financial instruments

0.20

–

1,161

– 1,161

312,172

51,161

– 363,333

Financial assets

Derivative financial instruments

0.61

–

227

– 227

CAMBRIDGE INDUSTRIAL TRUST | ANNUAL REPORT 2014

160