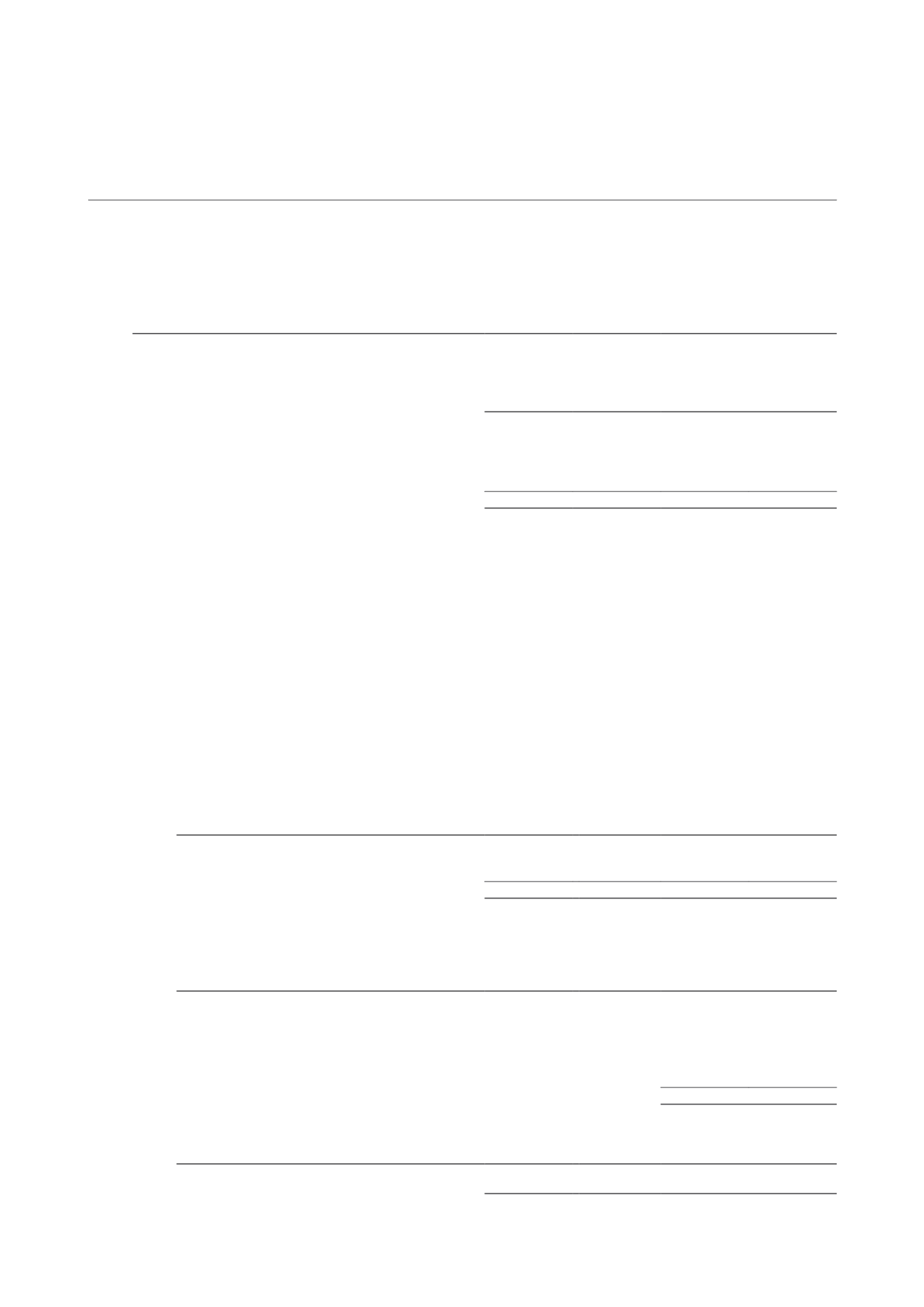

NOTES TO THE FINANCIAL STATEMENTS

19 Income tax expense

Group

Trust

2014

2013

2014

2013

$’000

$’000

$’000

$’000

Reconciliation of effective tax rate

Total return for the year

before income tax

45,418 118,895

45,524 105,537

Income tax using Singapore tax rate of 17% (2013: 17%)

7,721

20,212

7,739

17,941

Income not subject to tax

(178)

(5,947)

(178)

(5,947)

Non-tax deductible items

2,268

(6,872)

2,250

(4,601)

Tax transparency

(9,709)

(7,382)

(9,709)

(7,382)

Income tax expense

102

11

102

11

Income tax expense relates to tax payable on the rental support income received by the Trust.

In 2013, the Group recorded a gain from the disposal of the Trust’t interest in the 63 Hillview property.

The Manager is of the view that the gain is capital in nature and should not be subject to income tax. No

provision has been made for the contingent tax. If the gain is taxable, income tax payable on the gain, based on

management’s estimate, would be approximately $11.4 million.

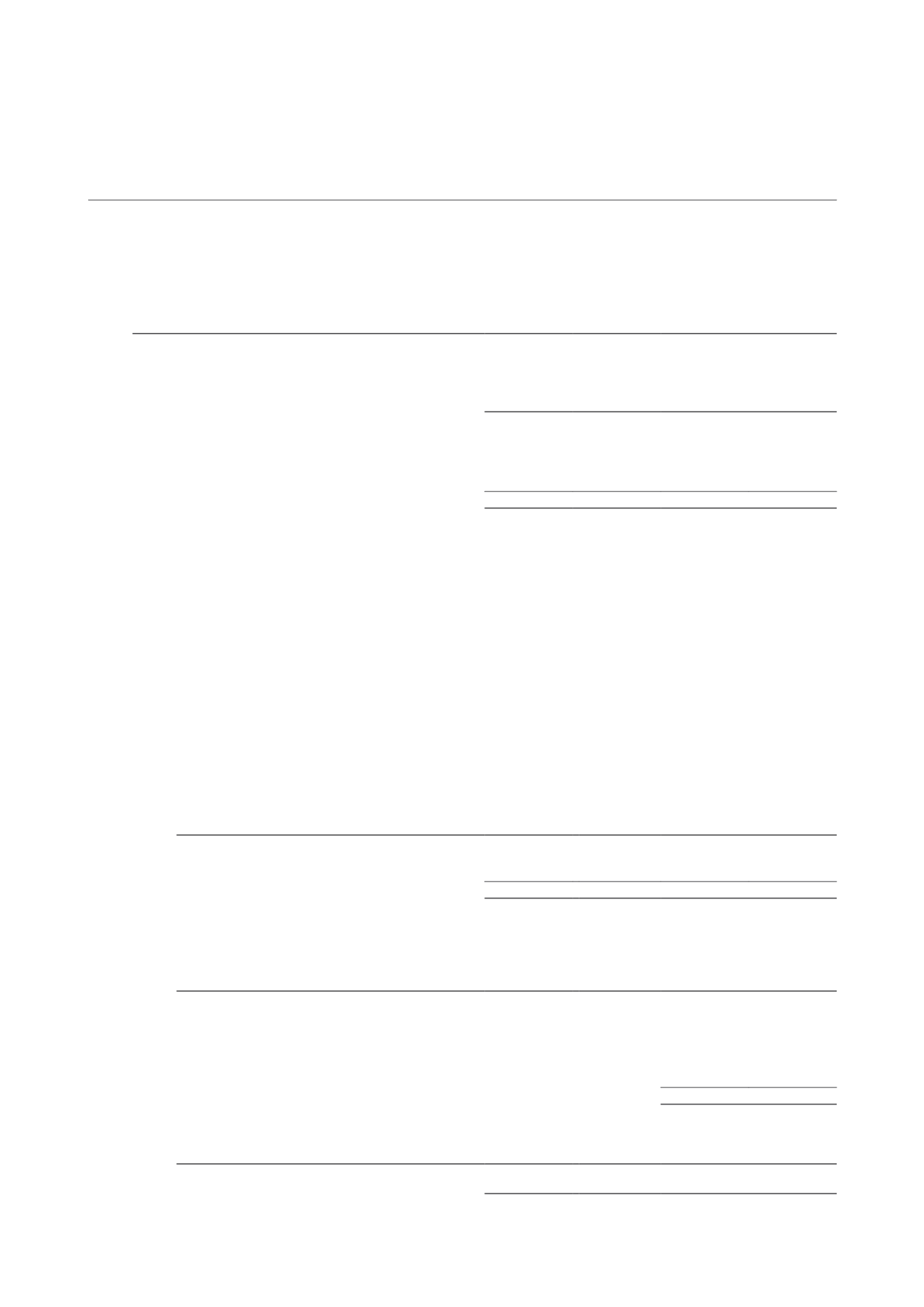

20 Earnings and distribution per unit

(a)

Basic earnings per unit

The calculation of basic earnings per unit is based on the weighted average number of units in issue and

the total return after tax for the financial year.

Group

Trust

2014

2013

2014

2013

$’000

$’000

$’000

$’000

Total return before income tax

45,418 118,895

45,524 105,537

Less: Income tax expense

(102)

(11)

(102)

(11)

Total return after income tax

45,316 118,884

45,422 105,526

Group and Trust

Number of Units

2014

2013

‘000

‘000

Weighted average number of units:

– Units issued at beginning of year

1,239,339 1,216,015

Effect of issue of new units:

– Distribution Reinvestment Plan

13,966

11,368

– Management fees paid in units

173

–

1,253,478 1,227,383

Group

Trust

2014

2013

2014

2013

Basic earnings per unit (cents)

3.615

9.686

3.624

8.598

CAMBRIDGE INDUSTRIAL TRUST | ANNUAL REPORT 2014

152