NOTES TO THE FINANCIAL STATEMENTS

25 Financial instruments (Cont’d)

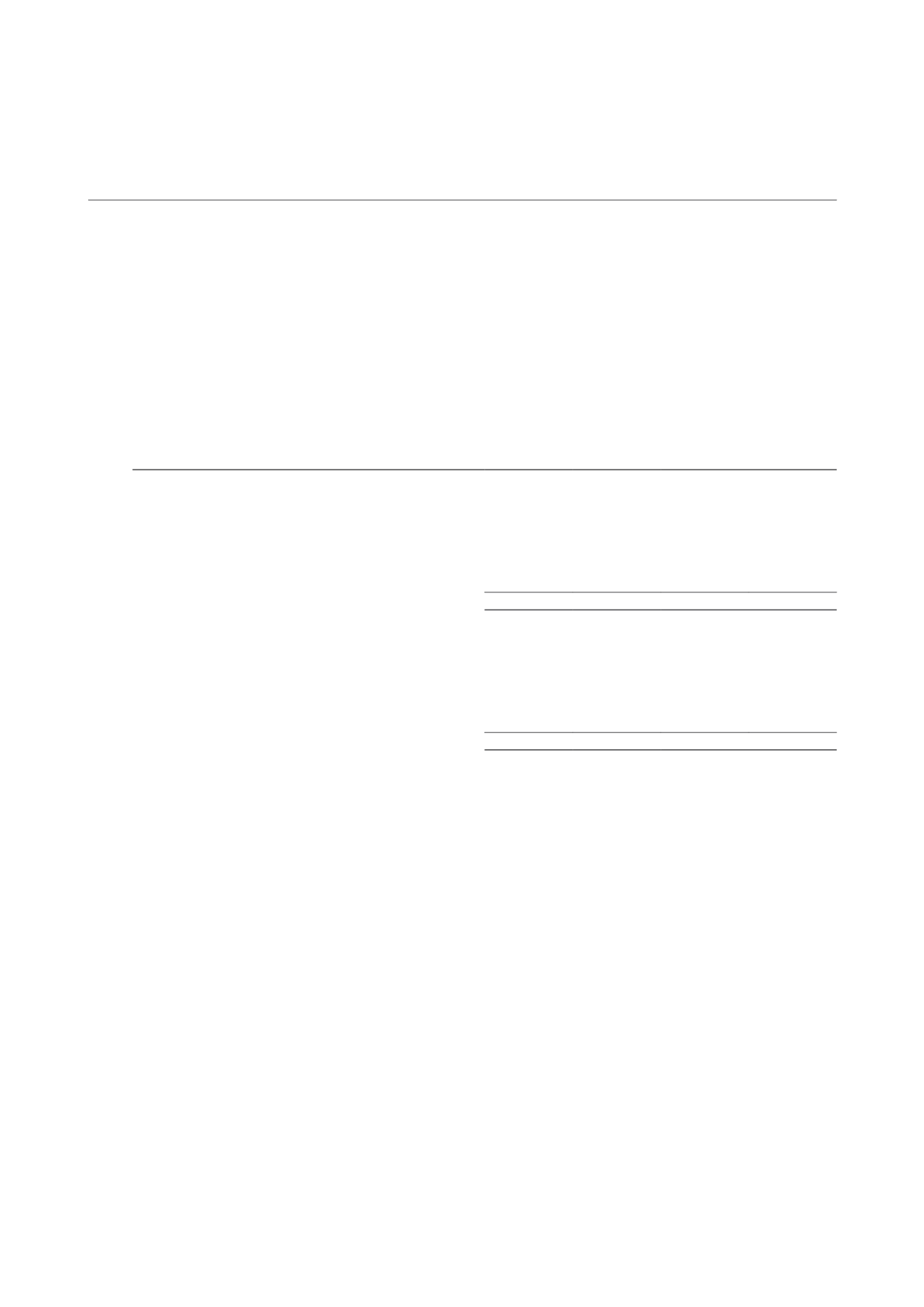

Sensitivity analysis for variable rate instruments

As at 31 December 2014 and 2013, a change of 100 basis points in interest rates would have increased/(decreased)

Unitholders’ funds and total return by the amounts shown below:

Total Return

Unitholders’

Funds

Group and Trust

100 bp

increase

100 bp

decrease

100 bp

increase

100 bp

decrease

$’000

$’000

$’000

$’000

31 December 2014

Variable rate instruments

– Interest expense

(3,000)

2,213

(3,000)

2,213

Interest rate swaps

– Interest expense

2,500

(1,845)

2,500

(1,845)

– Change in fair value of financial derivatives

3,455

(2,591)

3,455

(2,591)

2,955

(2,223)

2,955

(2,223)

31 December 2013

Variable rate instruments

– Interest expense

(3,122)

691

(3,122)

691

Interest rate swaps

– Interest expense

2,500

(553)

2,500

(553)

– Change in fair value of financial derivatives

5,903

(2,455)

5,903

(2,455)

5,281

(2,317)

5,281

(2,317)

The Group does not designate interest rate swaps as hedging instruments under a cash flow hedge accounting

model. Therefore a change in interest rates at the reporting date would not affect Unitholders’ funds.

Currency risk

At present, all transactions involving the Group are denominated in Singapore dollars and the Group faces no

currency risk. If this were to change in the future, the Manager would consider currency hedging to the extent

appropriate.

Liquidity risk

The Manager monitors the liquidity risk of the Group and maintains a level of cash and cash equivalents deemed

adequate by management to finance the Group’s operations. Typically, the Group ensures that it has sufficient

cash on demand to meet expected operational expenses for a reasonable period, including the servicing of

financial obligations; this excludes the potential impact of extreme circumstances that cannot be reasonably

predicted, such as natural disasters.

The Manager monitors and observes the CIS Code issued by the MAS concerning limits on total borrowings.

CAMBRIDGE INDUSTRIAL TRUST | ANNUAL REPORT 2014

162