NOTES TO THE FINANCIAL STATEMENTS

20 Earnings and distribution per unit (Cont’d)

(b)

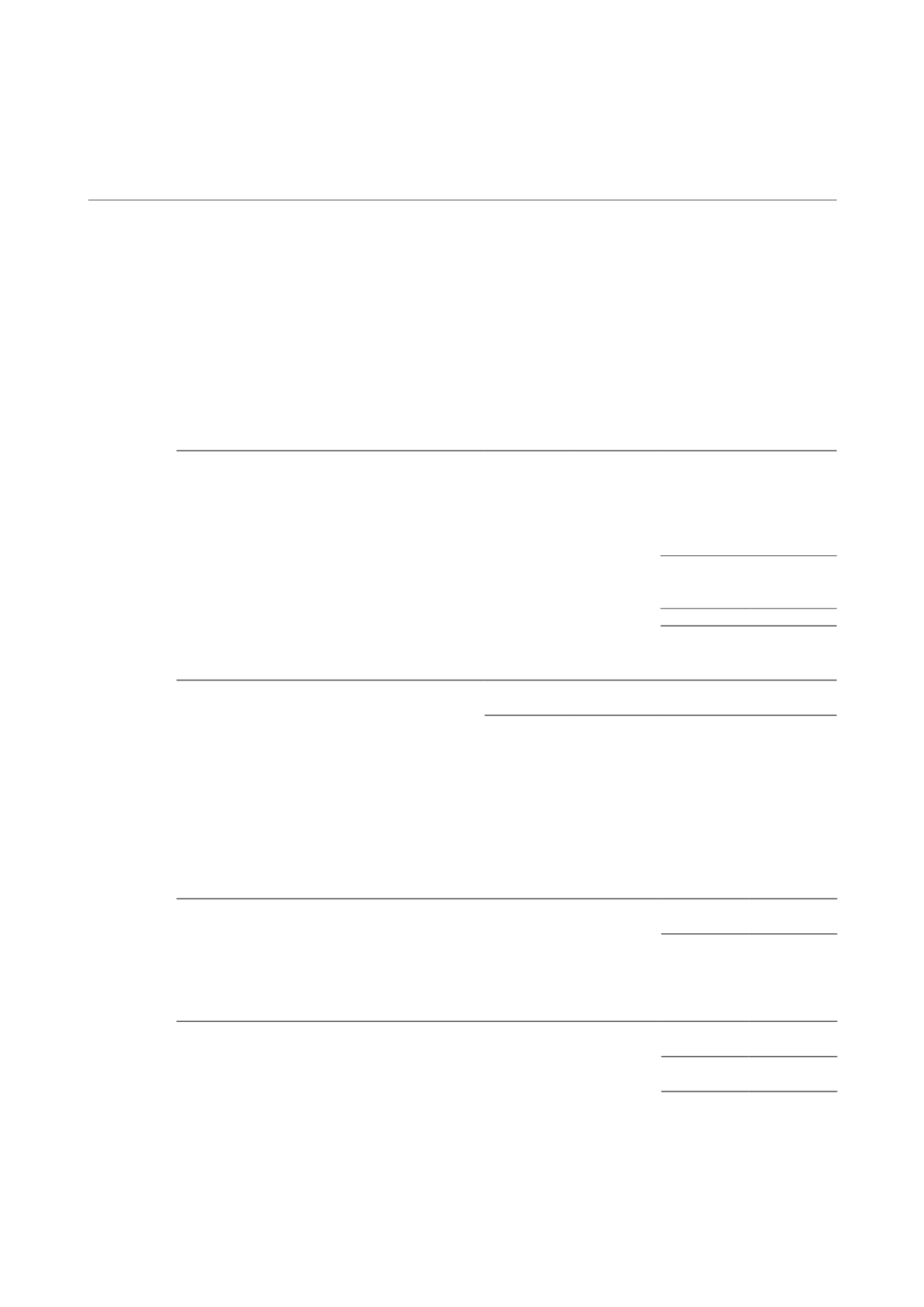

Diluted earnings per unit

The calculation of diluted earnings per unit is based on the weighted average number of units in issue and

issuable and the total return after tax for the financial year.

Group and Trust

Number of Units

2014

2013

‘000

‘000

Weighted average number of units:

– Units issued at beginning of year

1,239,339 1,216,015

Effect of issue of new units:

– Distribution Reinvestment Plan

13,966

11,368

– Management fees paid in units

173

–

1,253,478 1,227,383

Effect of units to be issued:

– Management fees payable in units

635

–

1,254,113 1,227,383

Group

Trust

2014

2013

2014

2013

Diluted earnings per unit (cents)

3.613

9.686

3.622

8.598

(c )

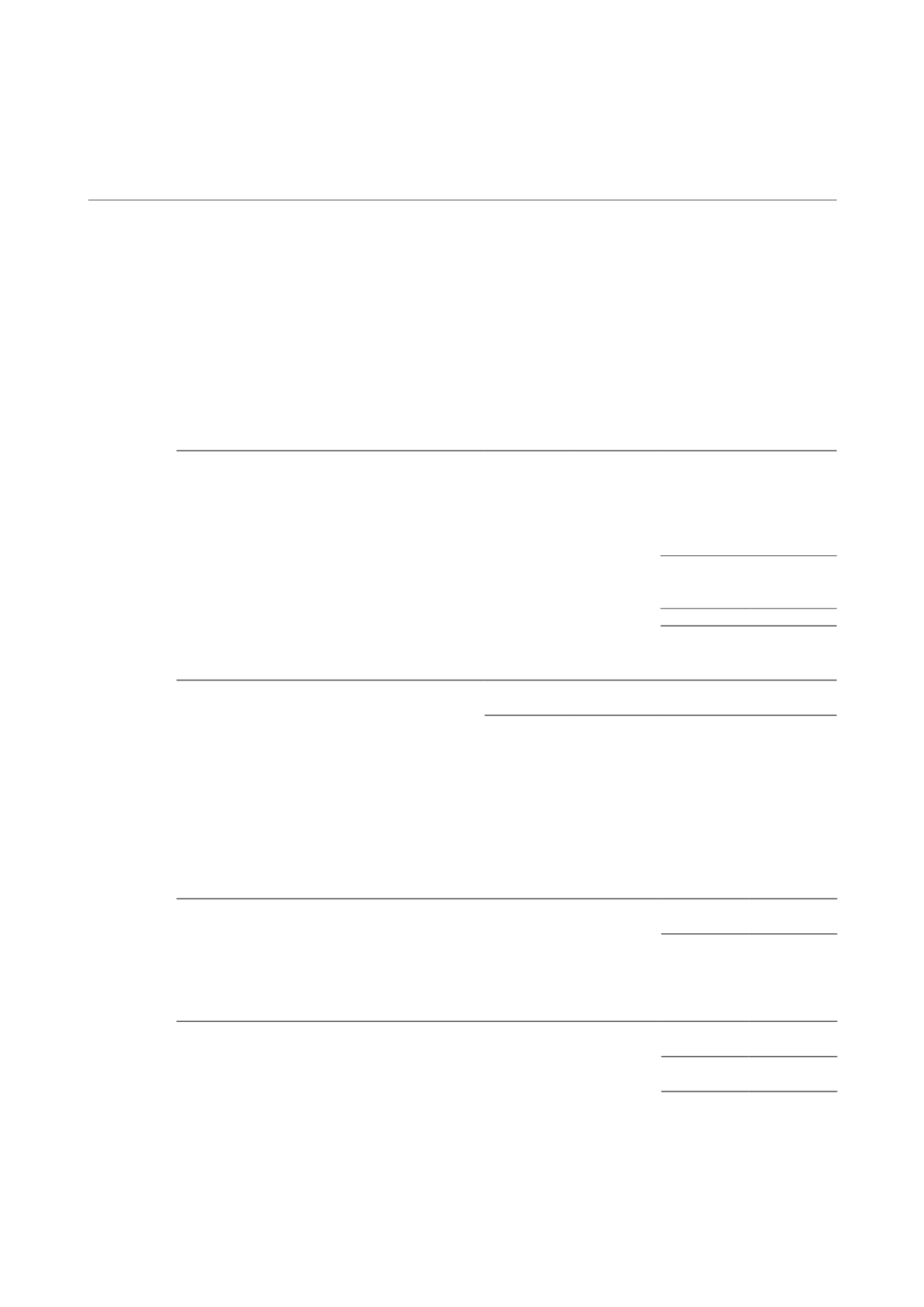

Distribution per unit

The calculation of distribution per unit is based on the total amount available for distribution for the

financial year and the applicable number of units which is either the number of units in issue at the end

of each period or the applicable number of units in issue during the year.

Group and Trust

2014

2013

$’000

$’000

Total amount available for distribution

63,035

61,286

Number of Units

2014

2013

’000

’000

Applicable number of units for the calculation of DPU

1,259,692 1,231,579

Distribution per unit (cents)

5.004

4.976

CAMBRIDGE INDUSTRIAL TRUST | A WINNING FORMULA

153