NOTES TO THE FINANCIAL STATEMENTS

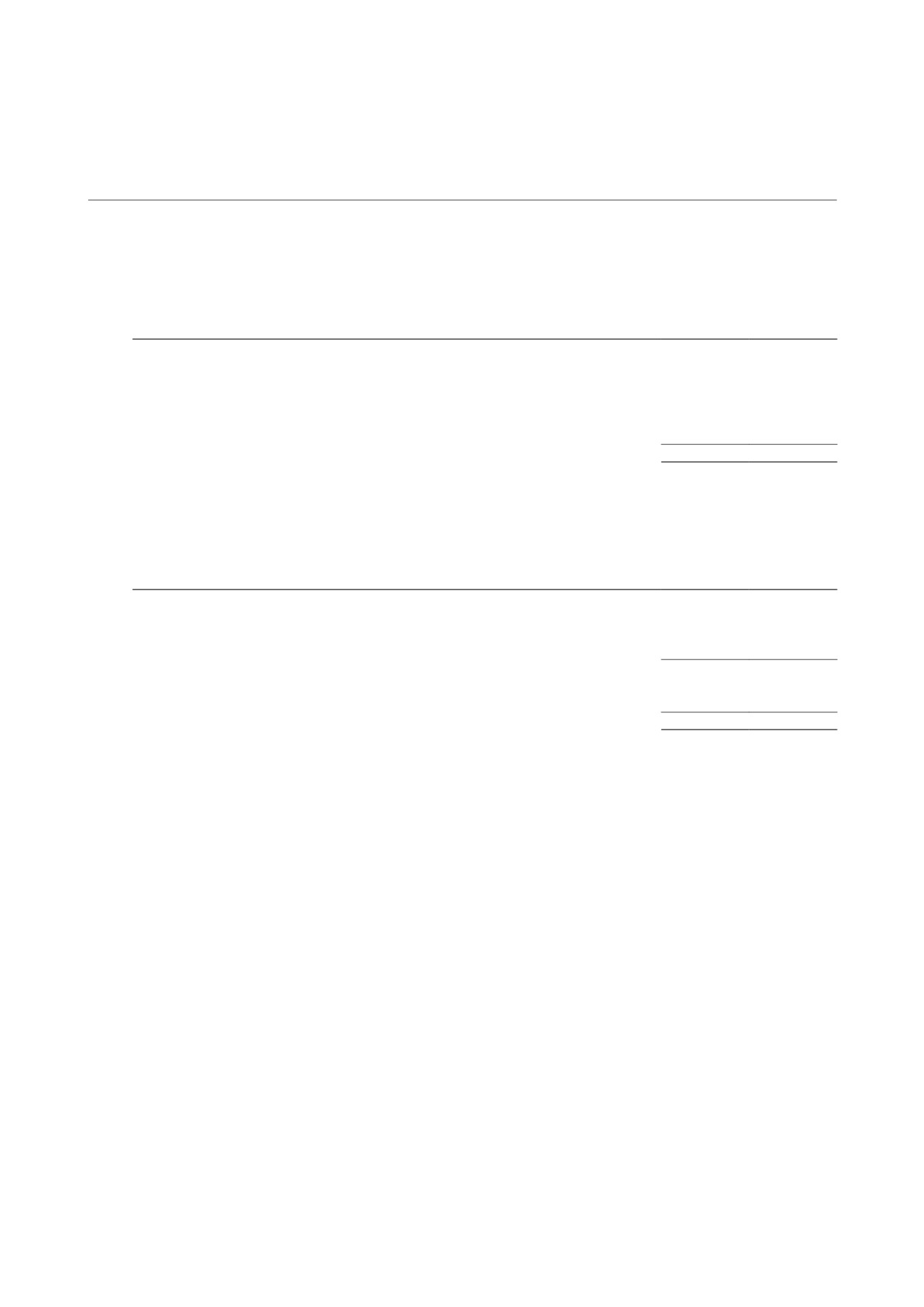

14 Property expenses

Group and Trust

2014

2013

$’000

$’000

Land rental

5,629

4,595

Property and lease management fees

3,955

3,349

Property tax

4,443

3,694

Repair and maintenance expenses

3,995

2,585

Other property operating expenses

3,512

1,853

21,534

16,076

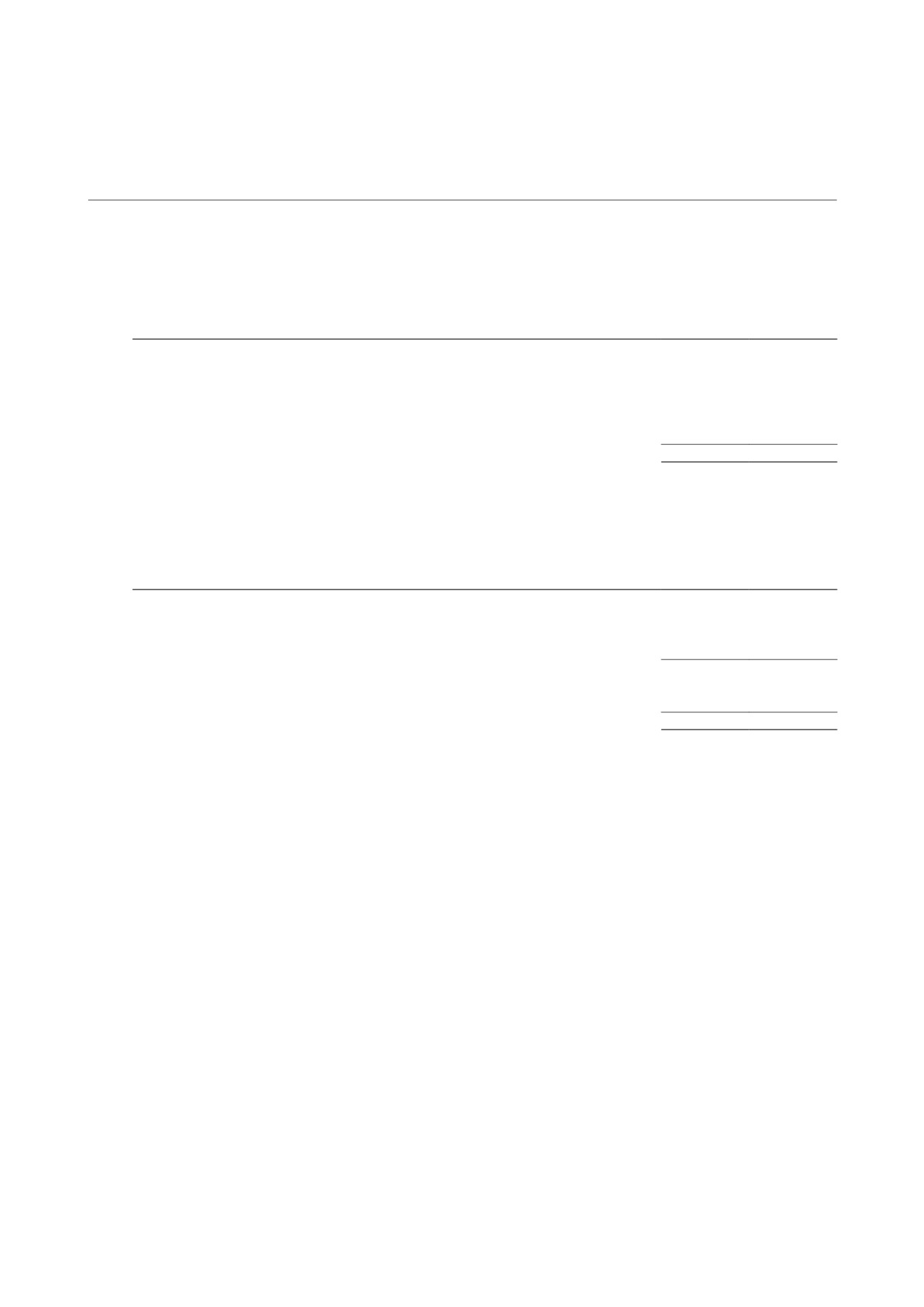

15 Management fees and performance fees

Group and Trust

2014

2013

$’000

$’000

Management fees

– Management fees paid and payable in cash

4,210

6,454

– Management fees paid and payable in units

2,358

–

6,568

6,454

Performance fees

– Performance fees paid and payable in cash

1,684

13,869

8,252

20,323

For the six month period ended 30 June 2014, CIT’s Trust Index exceeded the total return of the Cambridge

Benchmark Index, resulting in the Manager having an entitlement to performance fees of approximately $1.7 million.

For the six month period ended 30 June 2013, CIT’s Trust Index exceeded the total return of the Cambridge

Benchmark Index, resulting in the Manager having an entitlement to performance fees of approximately $27.7

million. The Manager has voluntarily and irrevocably elected a one off waiver to reduce the performance fee

for the half year to approximately $13.9 million, being 50% of the Manager’s entitlement under the Trust Deed.

On 17 April 2014, the Manager unilaterally reduced the Tier 2 performance fee rate from 15% to 5%. Further

details of the performance fee are disclosed in Note 1 (B)(ii).

The payment for the total of the management fees and performance fees are capped at 0.8% of the Trust’s total

deposited property value per financial year under the Trust Deed. The amount of performance fees in excess of

the fee cap has been carried forward for payment in the future half year periods.

There was no performance fee payable for the six month period ended 31 December 2014 and 31 December 2013,

respectively.

CAMBRIDGE INDUSTRIAL TRUST | ANNUAL REPORT 2014

150