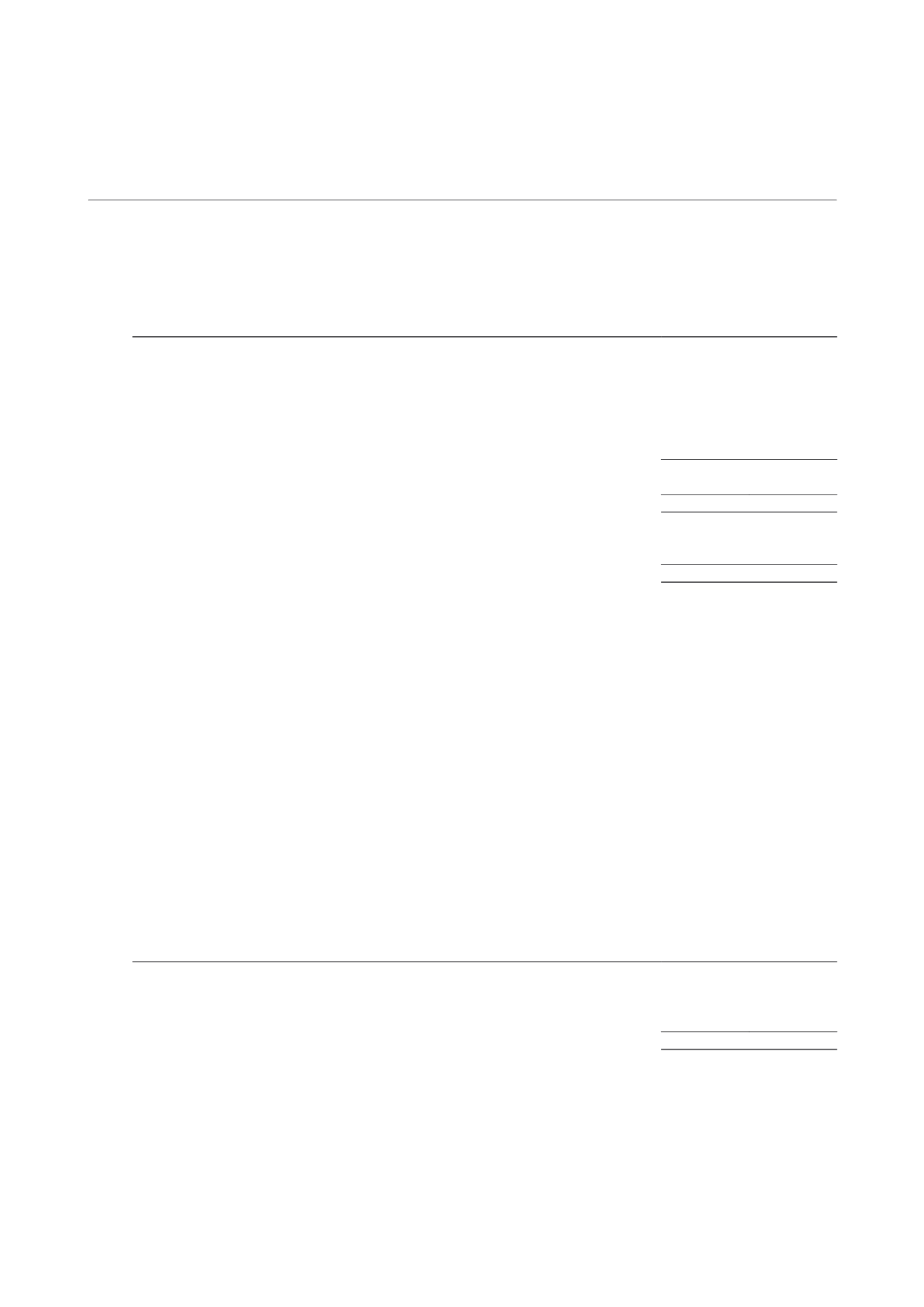

NOTES TO THE FINANCIAL STATEMENTS

4 Investment properties

Group and Trust

2014

2013

$’000

$’000

At 1 January

1,139,298 1,195,000

Acquisition of investment properties

143,170 101,022

Disposal of investment properties

(6,700)

(222,200)

Acquisition related costs

2,267

1,343

Capital expenditure incurred

16,320

1,492

Transfer from investment properties under development

57,958

28,785

1,352,313 1,105,442

Change in fair value during the year *

(5,433)

33,856

At 31 December

1,346,880 1,139,298

Investment properties (non-current)

1,335,180 1,132,598

Investment properties held for divestment (current)

11,700

6,700

1,346,880 1,139,298

The disclosure on determination of fair value in relation to investment properties is included in Note 22.

* The fair value loss of $5.4 million, together with an adjustment of $2.5 million (2013: Nil) to recognise rental income on a straight line basis

in accordance with FRS 17 Leases, aggregate to $7.9 million (2013: gain of $33.9 million) as disclosed in the Statement of Total Return.

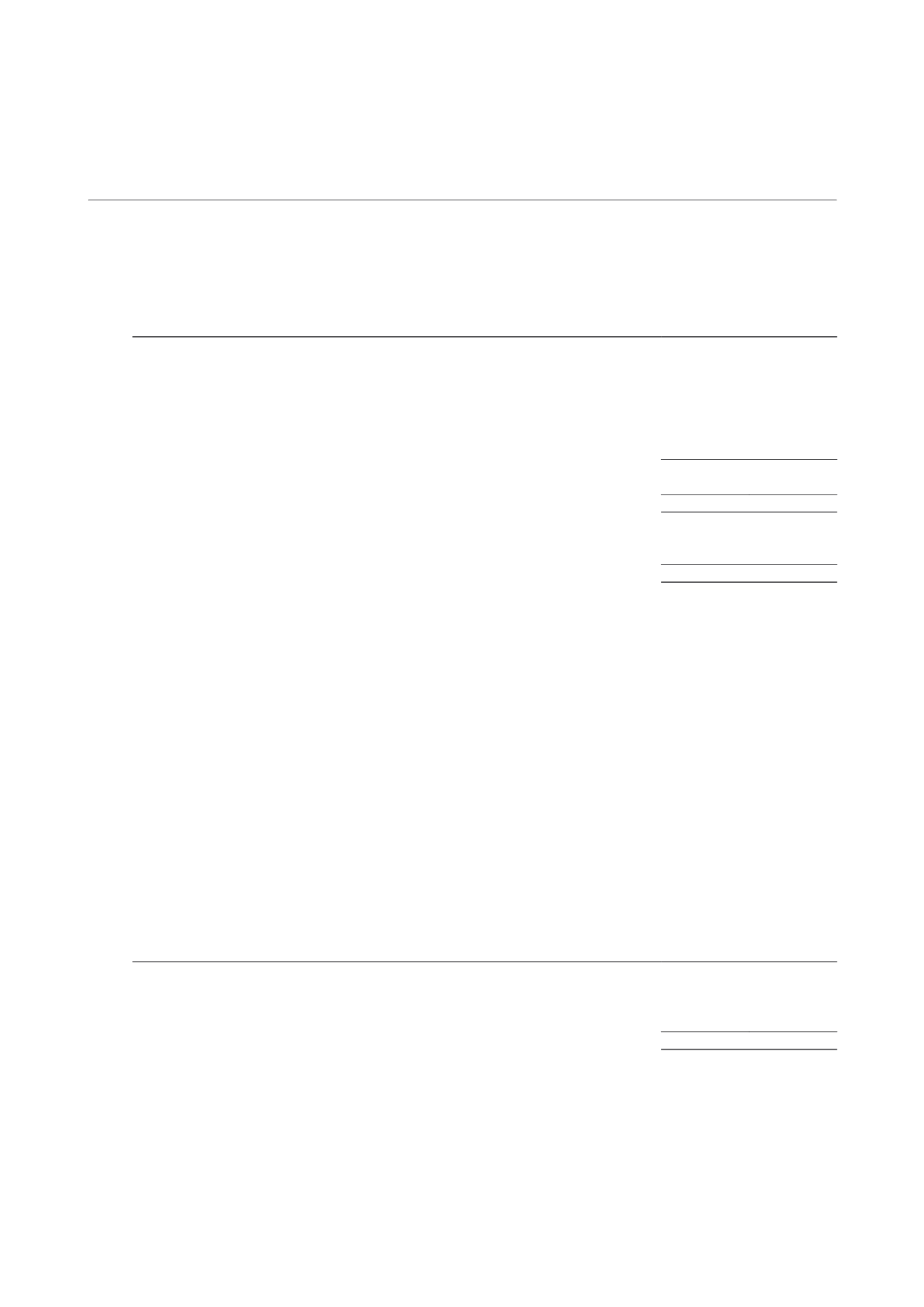

Investment Property held for Divestment

An investment property with a carrying value of $11.7 million (2013: $6.7 million) as at 31 December 2014, has

been reclassified as an investment property held for divestment. This reclassification is required by FRS 105

Non-current Assets held for Sale and Discontinued Operations

as the divestment is planned within the next

12 months from the reporting date. The property held for divestment at 31 December 2013 was sold during

the year.

Security

As at the reporting date, certain investment properties have been mortgaged as security for loan facilities granted

by financial institutions to the Group (see Note 10). The value of the security per facility is as follows:

Group and Trust

2014

2013

$’000

$’000

Club Loan Facility

602,610 535,898

Term Loan Facility

246,400 248,900

Revolving Credit Facility

90,400

–

939,410 784,798

CAMBRIDGE INDUSTRIAL TRUST | ANNUAL REPORT 2014

136