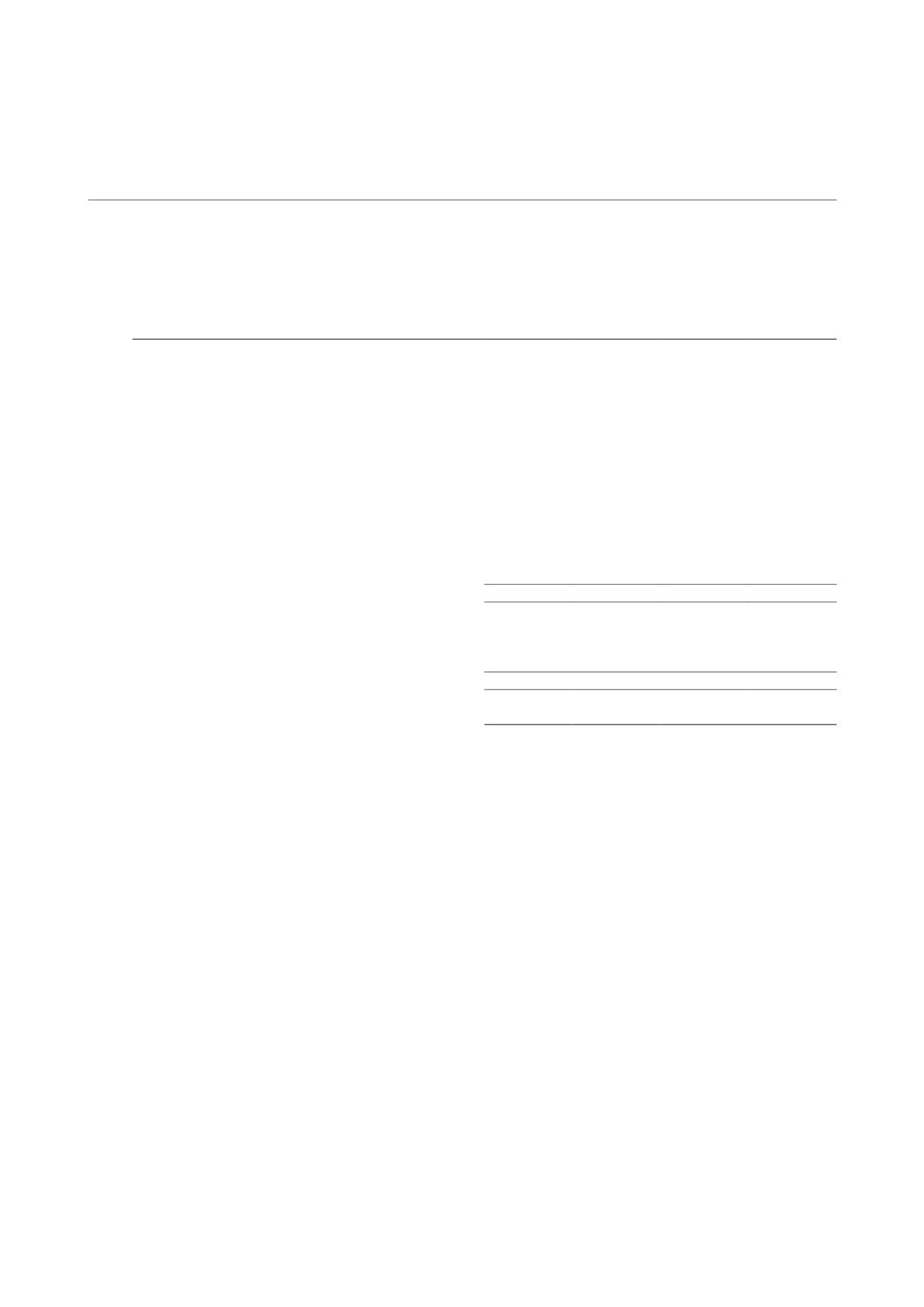

NOTES TO THE FINANCIAL STATEMENTS

9 Trade and other payables

Group

Trust

2014

2013

2014

2013

$’000

$’000

$’000

$’000

Current liabilities

Trade payables and accrued operating expenses

13,255

13,390

13,245

13,378

Amounts due to related parties (trade):

– the Manager

4,746

3,460

4,746

3,460

– the Property Manager

71

284

71

284

– the Trustee

94

88

94

88

Amount due to subsidiary (non-trade)

–

–

1,478

716

Interest and loan commitment fee payable

2,024

2,158

546

1,442

Security deposits

1,509

1,670

1,509

1,670

Rent received in advance

909

248

909

248

Deposits and option fees received

89

120

89

120

Retention sums

3,717

9,900

3,717

9,900

Other payables

3

2

3

2

26,417

31,320

26,407

31,308

Non-current liabilities

Security deposits

7,006

3,129

7,006

3,129

Amounts due to the Manager *

5,292

8,857

5,292

8,857

12,298

11,986

12,298

11,986

Total trade and other payables

38,715

43,306

38,705

43,294

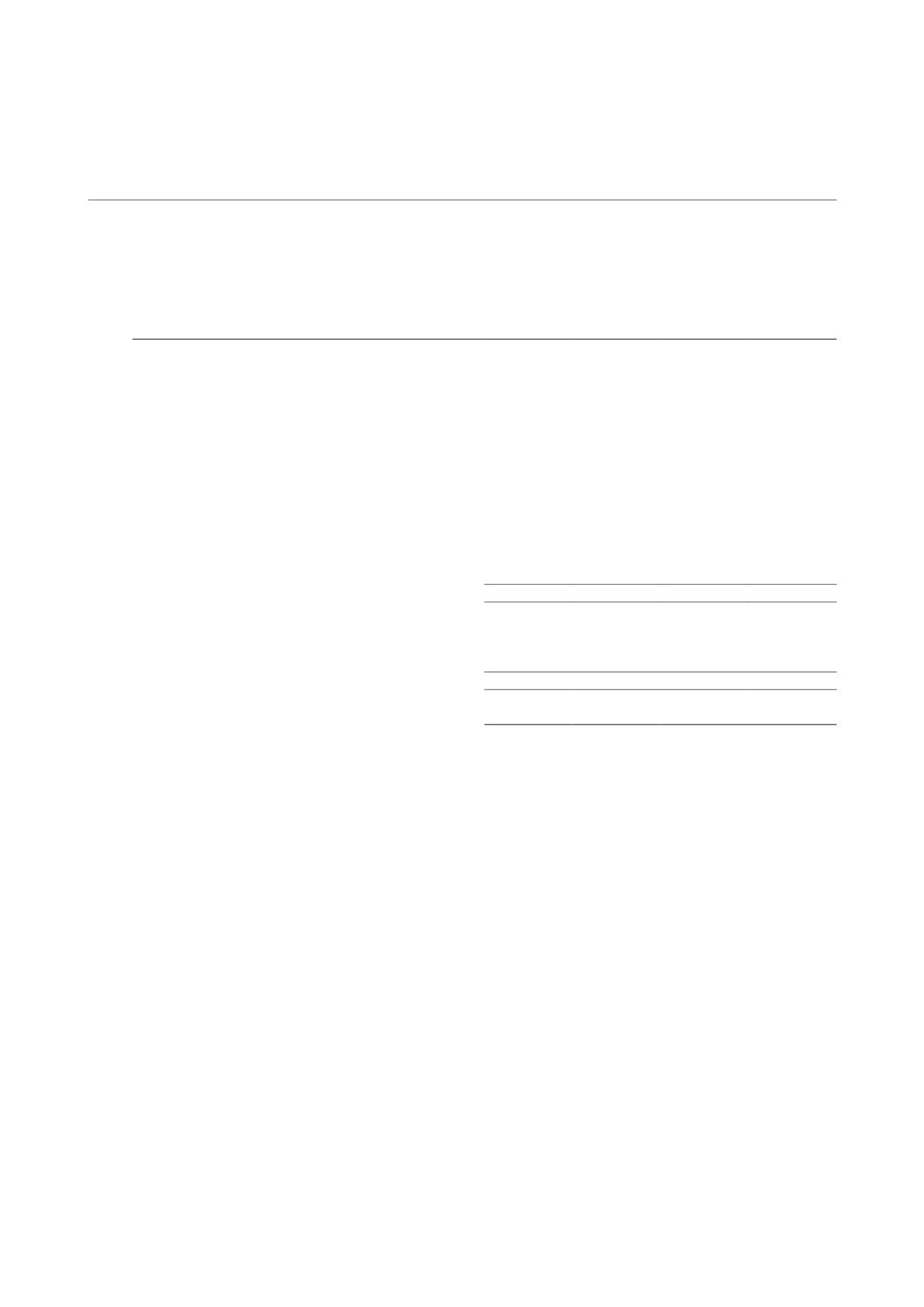

The amounts due to related parties and subsidiary are unsecured. Transactions with related parties and the

subsidiary are priced on terms agreed between the parties.

Retention sums relate to certain investment properties acquired and investment properties under development

during the financial year.

The Group and the Trust’s exposure to liquidity risk related to trade and other payables are disclosed in Note 10.

* The amounts due to the Manager related to performance fees payable in excess of the annual fee cap which will be carried forward for

payment in future half year periods. Further details are disclosed in Note 1B (ii).

CAMBRIDGE INDUSTRIAL TRUST | A WINNING FORMULA

141