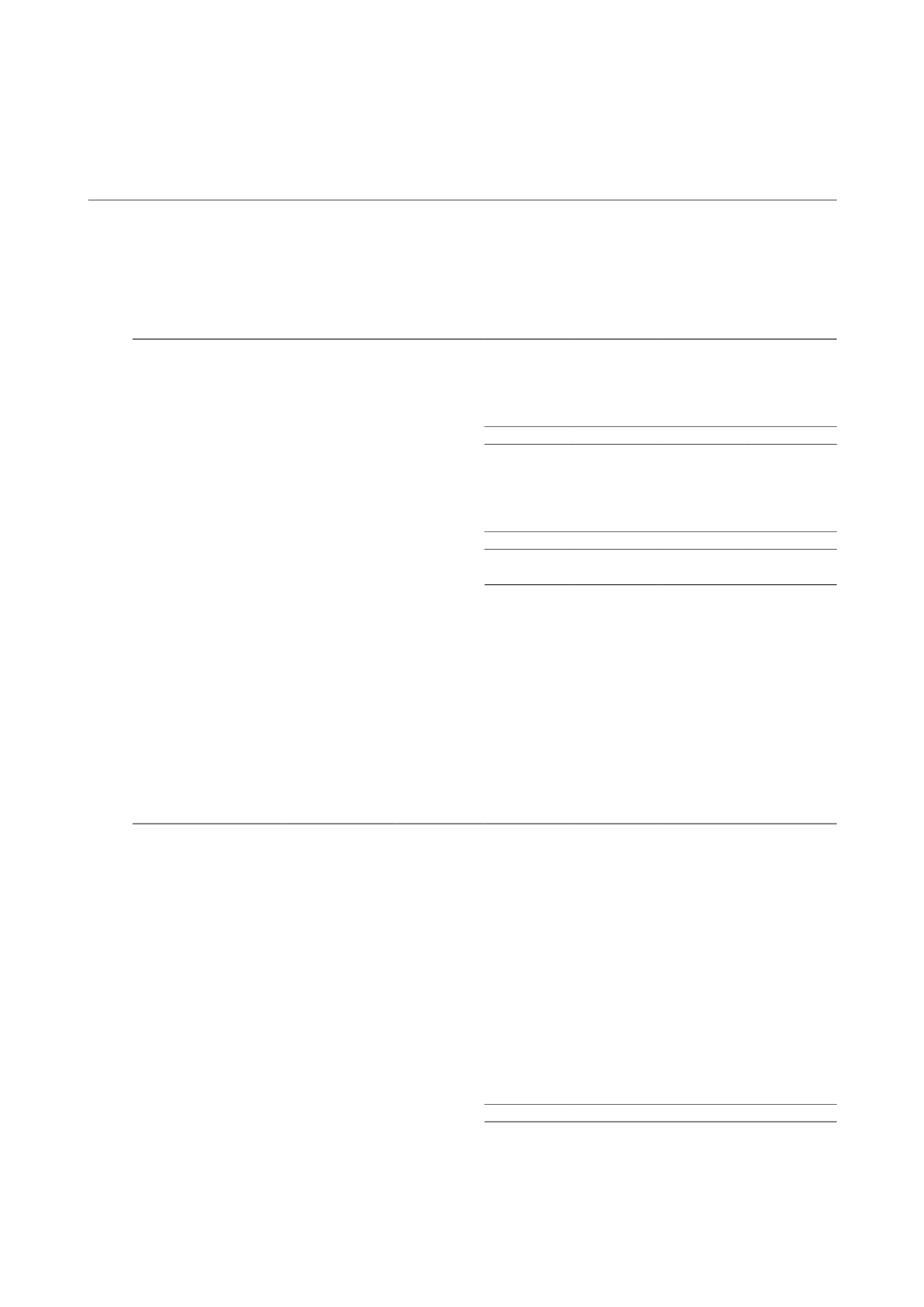

NOTES TO THE FINANCIAL STATEMENTS

10 Interest-bearing borrowings

Group

Trust

2014

2013

2014

2013

$’000

$’000

$’000

$’000

Current liabilities

Fixed rate notes (unsecured)

50,000

–

–

–

Loan from subsidiary (unsecured)

–

– 50,000

–

Unamortised loan transaction costs

(48)

–

(48)

–

49,952

– 49,952

–

Non-current liabilities

Secured loans

300,000 312,172 300,000 312,172

Fixed rate notes (unsecured)

130,000 50,000

–

–

Loan from subsidiary (unsecured)

–

– 130,000 50,000

Unamortised loan transaction costs

(4,504)

(7,269)

(4,504)

(7,269)

425,496 354,903 425,496 354,903

Total interest-bearing borrowings

475,448 354,903 475,448 354,903

The Group issued $130 million Singapore Dollar Medium Term Notes (“MTN”) under its $500 million multi-

currency MTN Programme during the financial year.

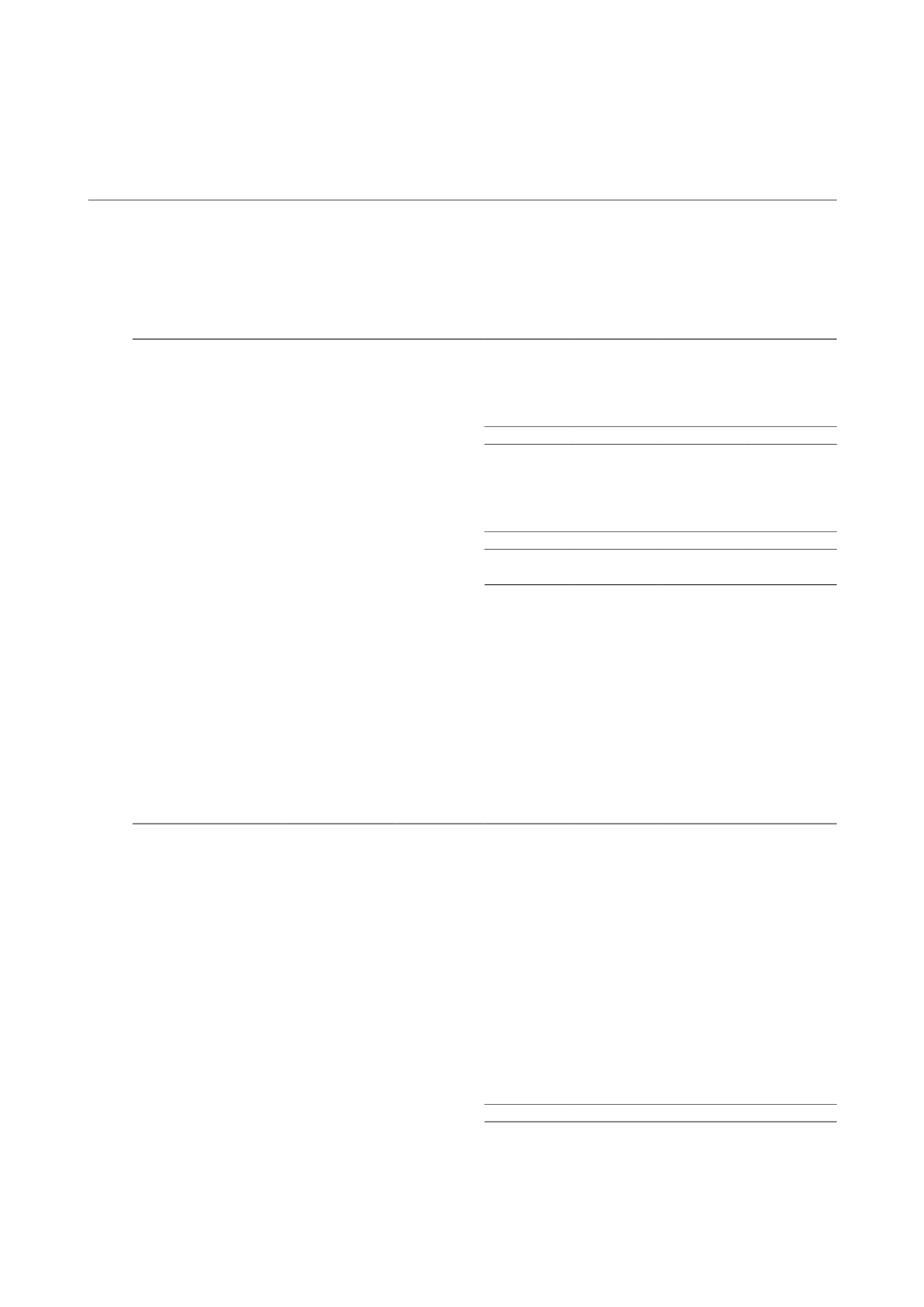

Terms and debt repayment schedule

Terms and conditions of outstanding loans and borrowings are as follows:

‹--------- 2014---------› ‹---------2013---------›

Group

Nominal

interest rate

Year of

maturity

Face

value

Gross

carrying

amount

Face

value

Gross

carrying

amount

%

$’000

$’000

$’000

$’000

Secured

Club loan facility

– S$ floating rate loan SOR* + margin

2016 200,000 200,000 200,000 200,000

(Facility A & B)

– S$ floating rate loan SOR* + margin

2016

–

– 12,172

12,172

(Facility D)

Term loan facility

– S$ floating rate loan SOR* + margin

2017 100,000 100,000 100,000 100,000

Unsecured

Medium Term Note

– S$ fixed rate note

4.75%

2015

50,000 50,000 50,000 50,000

– S$ fixed rate note

4.10%

2020 30,000 30,000

–

–

– S$ fixed rate note

3.50%

2018 100,000 100,000

–

–

480,000 480,000 362,172 362,172

CAMBRIDGE INDUSTRIAL TRUST | ANNUAL REPORT 2014

142