NOTES TO THE FINANCIAL STATEMENTS

8 Trade and other receivables (Cont’d)

Impairment losses

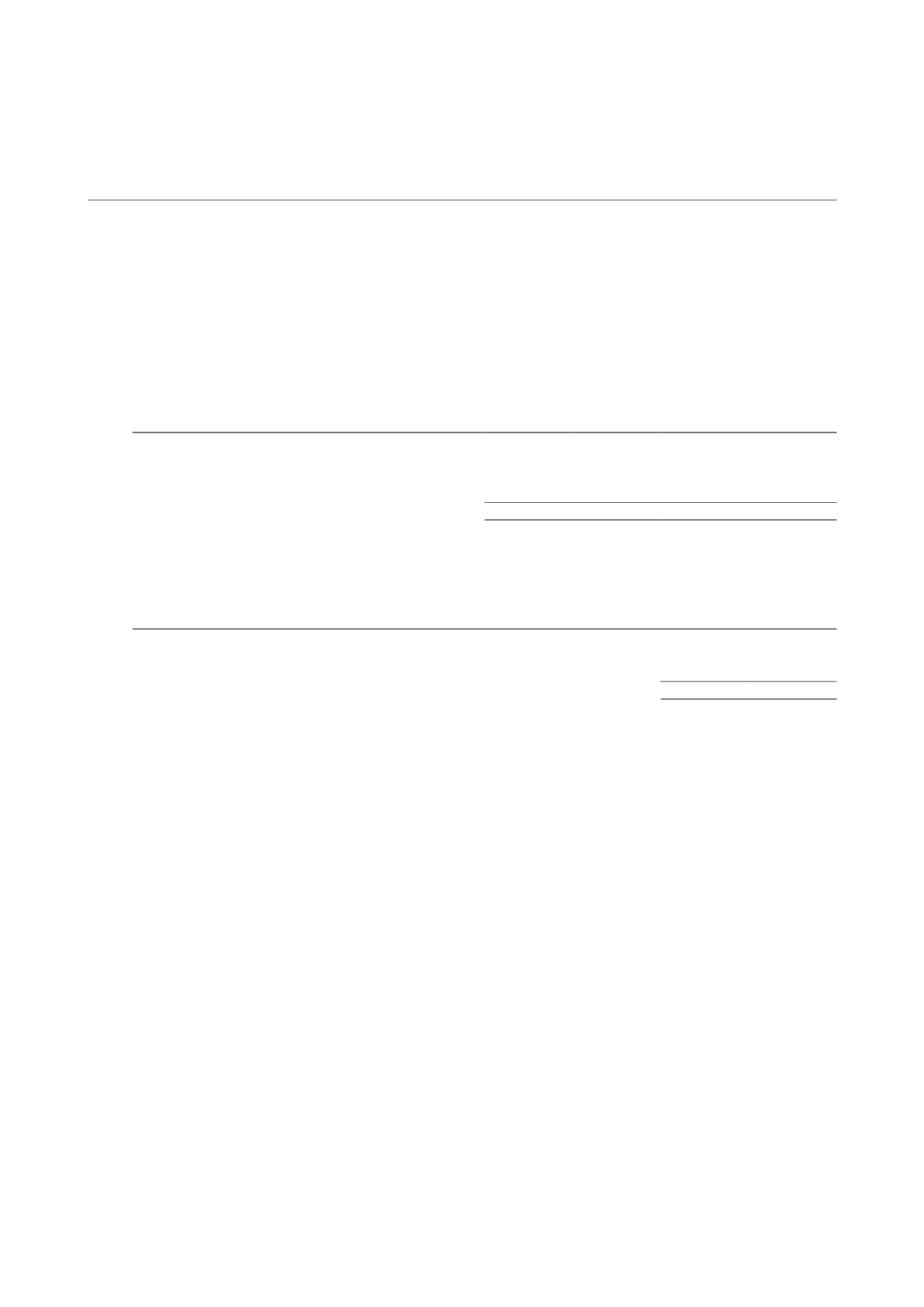

The ageing of trade receivables at the reporting date is as follows:

Gross Impairment

Gross Impairment

Group and Trust

receivables

2014

losses

2014

receivables

2013

losses

2013

$’000

$’000

$’000

$’000

Past due 0 – 30 days

97

–

448

–

Past due 31 – 120 days

18

–

209

–

More than 120 days past due

2,193

1,197

984

–

2,308

1,197

1,641

–

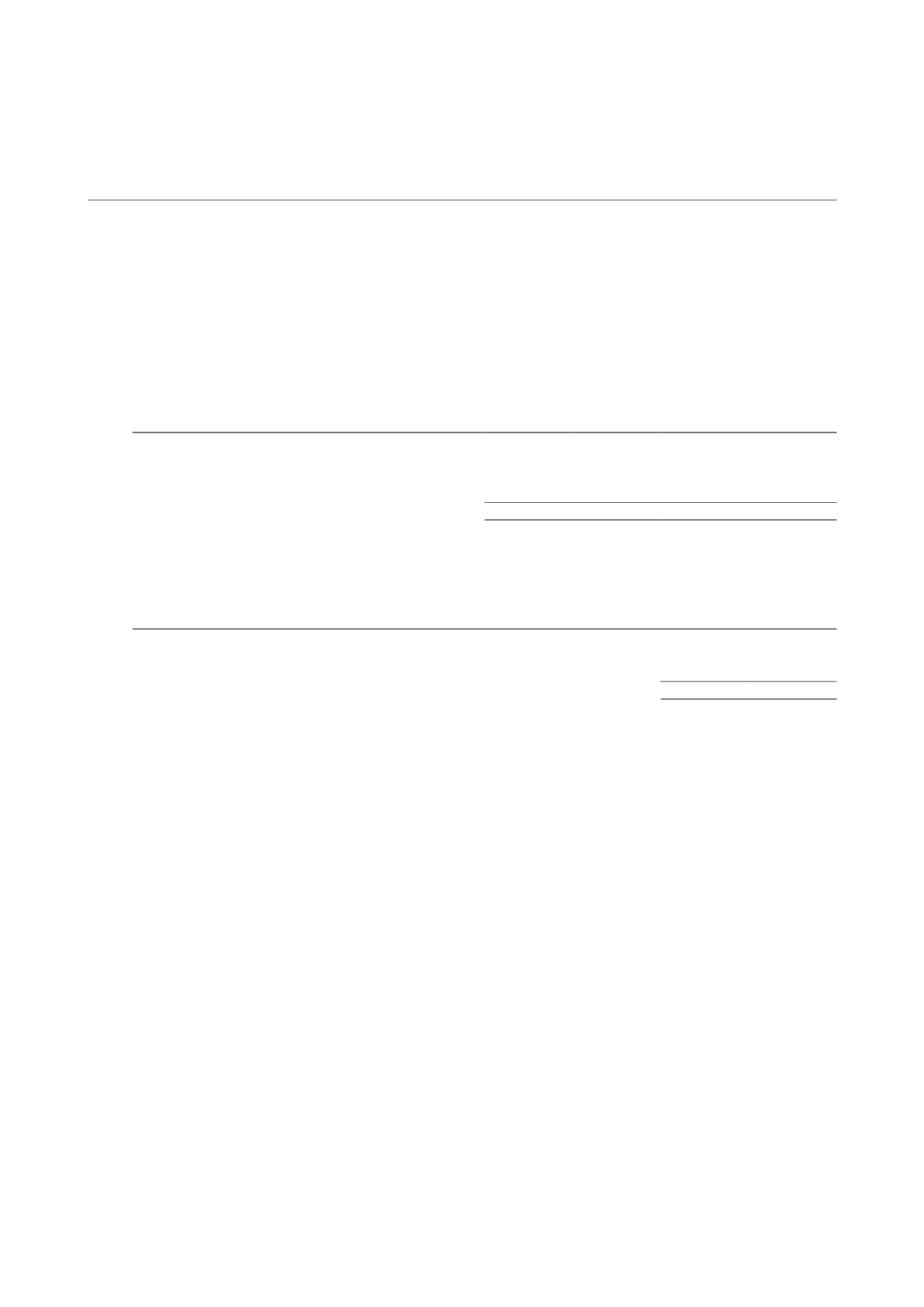

The movements in impairment loss in respect of trade receivables are as follows:

Group and Trust

2014

2013

$’000

$’000

At 1 January

–

–

Impairment losses made

1,197

–

At 31 December

1,197

–

Trade receivables are individually assessed for impairment at the end of the financial year. The impairment loss

relate to two debtors that are in financial difficulties and have defaulted in payments.

One of the debtors is in liquidation with its outstanding balances fully provided for while the other debtor is on

a repayment schedule in respect of the past due balances. For the latter debtor (a current tenant), a provision

of approximately $1.0 million was made for the outstanding balances which were over 120 days past due and

in excess of the bank guarantees held by CIT. An instalment plan has been established with the tenant and the

Manager is actively monitoring the tenant’s performance under this plan.

The Manager believes that no additional allowance is necessary in respect of the remaining trade receivables

during the financial year as these receivables are mainly due from tenants that have good payment records and

sufficient security in the form of the bankers’ guarantees, insurance bonds or cash security deposits as collaterals.

Source of estimation uncertainty

The Manager maintains an allowance for impairment at a level considered adequate to provide for potential

uncollectible receivables. The level of this allowance is evaluated on the basis of factors that affect the

collectability of debtors, their payment behaviour and known market factors. The Manager reviews the age and

status of receivables and identifies accounts that are to be provided for allowance on a continuous basis.

The Group and the Trust’s exposure to credit risk related to trade and other receivables is disclosed in Note 25.

CAMBRIDGE INDUSTRIAL TRUST | ANNUAL REPORT 2014

140