NOTES TO THE FINANCIAL STATEMENTS

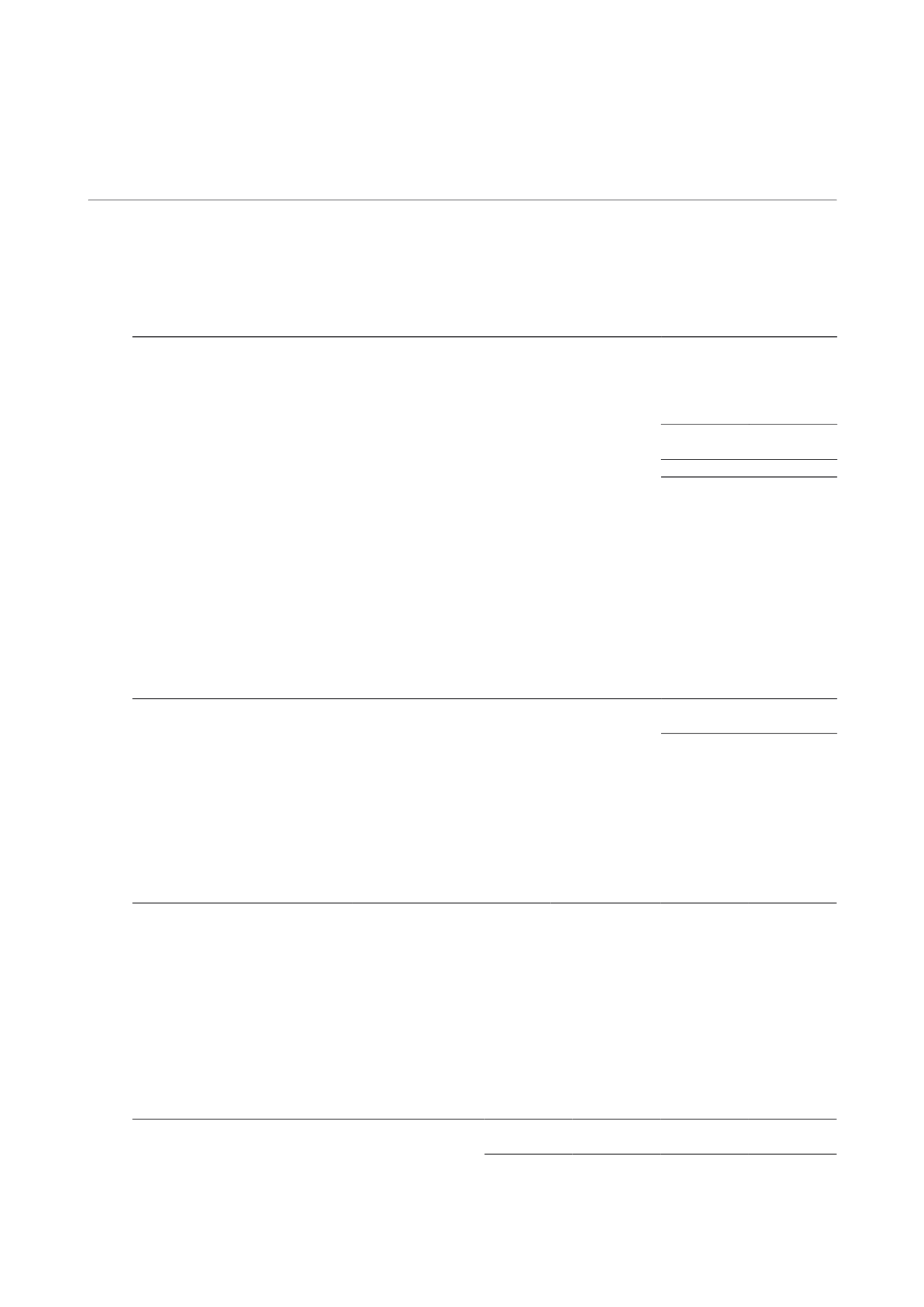

5 Investment properties under development

Group and Trust

2014

2013

$’000

$’000

At 1 January

22,292

19,000

Development costs incurred

35,299

32,020

Capitalised borrowing costs

367

57

Transfer to investment properties

(57,958)

(28,785)

– 22,292

Change in fair value during the year

–

–

At 31 December

– 22,292

Borrowing costs have been capitalised in the investment properties under development at rates ranging from

2.55% to 2.65% (2013: 2.55% to 2.60%) per annum.

The determination of fair value in relation to investment properties under development is disclosed in Note 22.

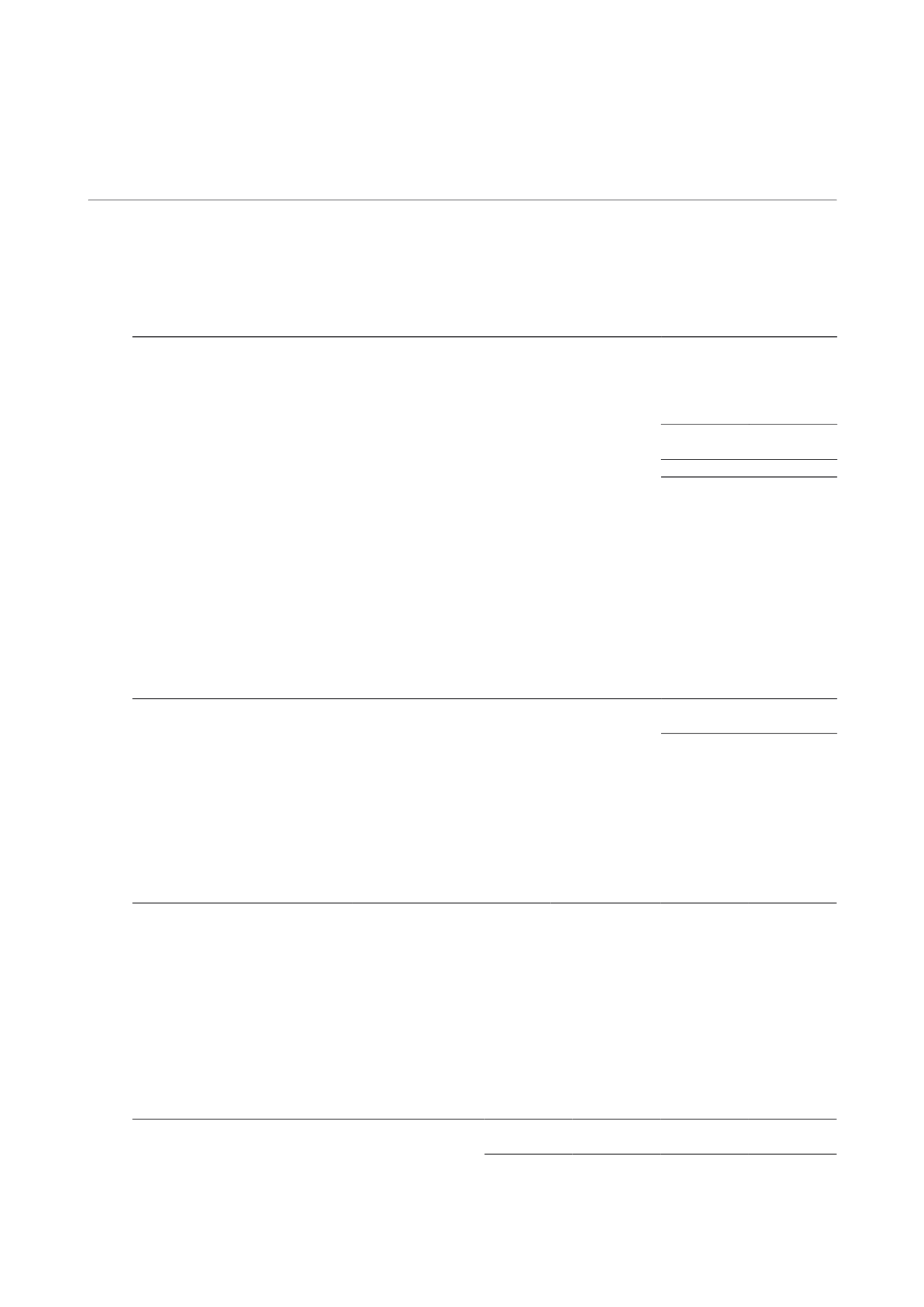

6 Investment in subsidiary

Trust

2014

2013

$’000

$’000

Unquoted equity investment, at cost

(1)

– *

– *

(1)

Investment in subsidiary being $1, established in February 2012.

Details of the subsidiary are as follows:

Country of

Effective equity

interest held by

the Group

Name of subsidiary

Principal activities

incorporation

2014

2013

%

%

#

Cambridge-MTN Pte. Ltd.

Provision of financial

and treasury services

Singapore

100

100

#

Audited by KPMG Singapore

* Less than $1,000

7 Investment in jointly-controlled entity

Group

Trust

2014

2013

2014

2013

$’000

$’000

$’000

$’000

Unquoted equity investment

16,327

16,435

3,078

3,078

The jointly-controlled entity holds a leasehold property at 3 Tuas South Avenue 4 which it acquired in March

2013. This property, which is fully leased, comprises a 30-year leasehold interest commencing on 1 May 1999

with an option for a 30-year extension.

CAMBRIDGE INDUSTRIAL TRUST | A WINNING FORMULA

137