NOTES TO THE FINANCIAL STATEMENTS

7 Investment in jointly-controlled entity (Cont’d)

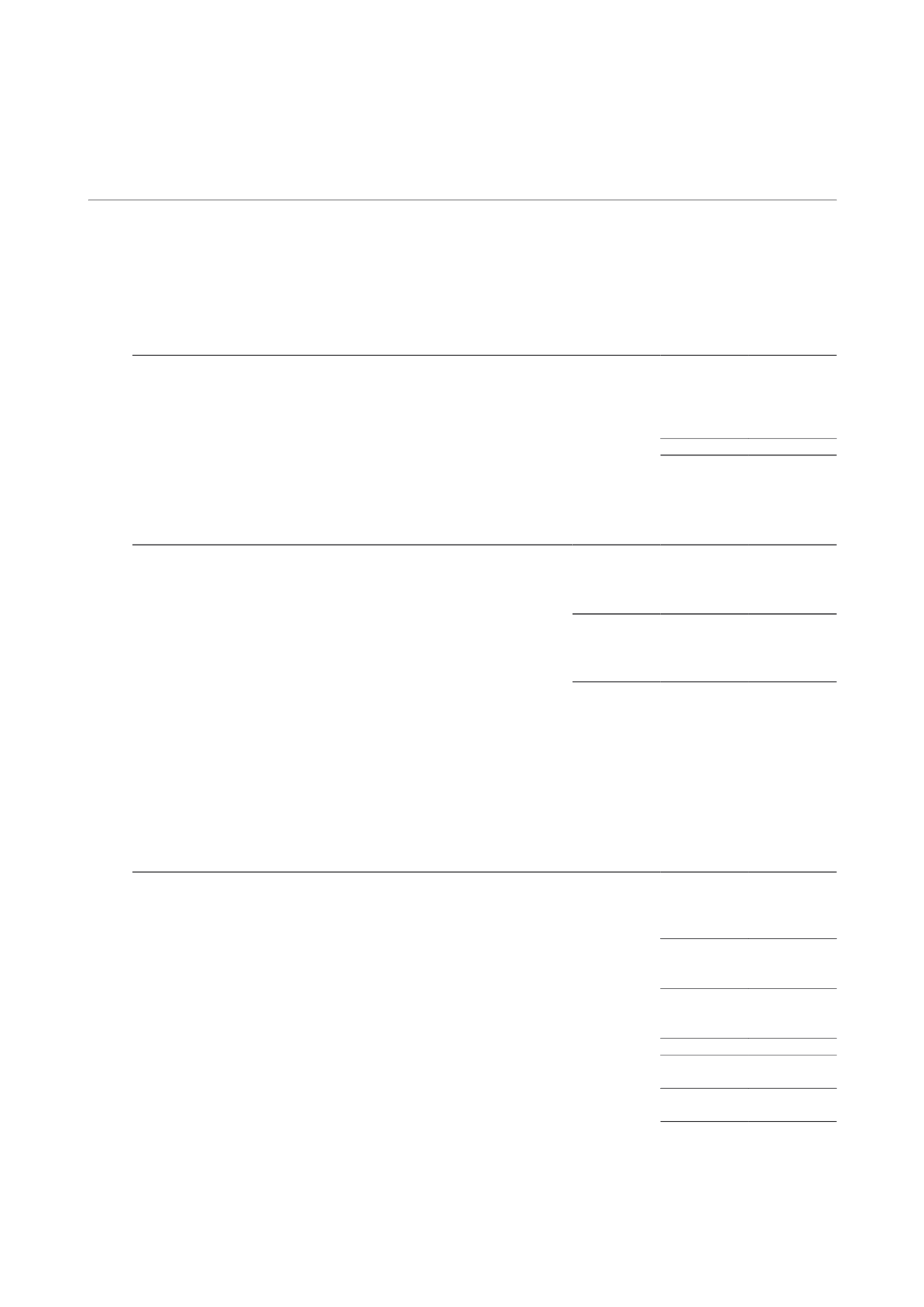

The Group’s share of the jointly-controlled entity’s lease commitments is as follows:

2014

2013

$’000

$’000

Non-cancellable operating lease rental receivable:

– Within 1 year

1,089

1,035

– After 1 year but within 5 years

6,477

6,160

– After 5 years

27,844

29,250

35,410

36,445

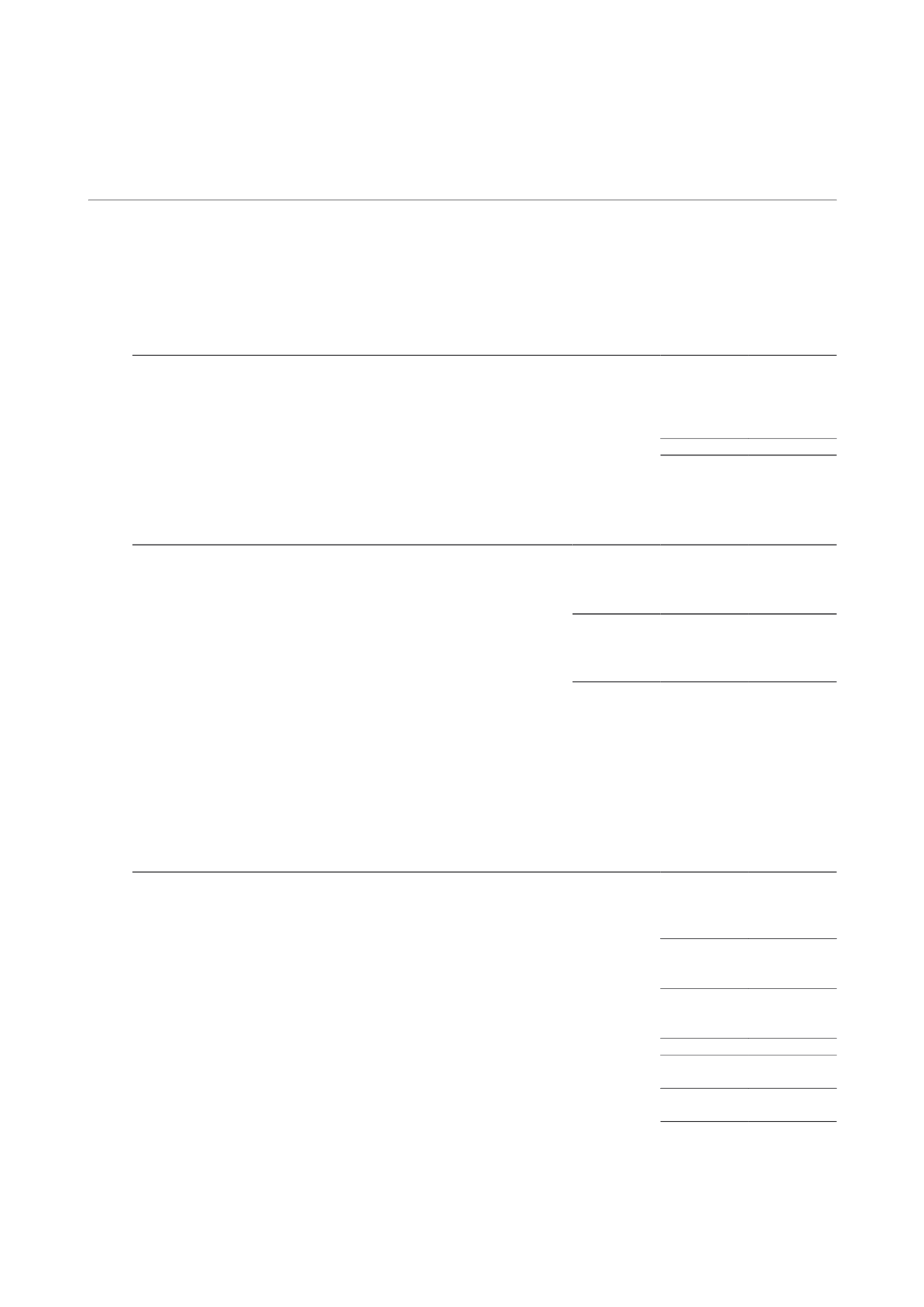

Non-cancellable operating lease payable:

Gross

amount

(5)

Borne by

tenants

Net

amount

(6)

$’000

$’000 $’000

2014

Land rents

JTC

20,828

(6,166)

14,662

2013

Land rents

JTC

22,602

(6,691)

15,911

(5)

This represents the land rents payable to JTC for the period from 1 May 2029 to the end of the land lease on 30 April 2059.

(6)

This represents the amount of land rent payable to JTC from 19 March 2038 to 30 April 2059, all of which is due after 5 years from the reporting

date. Land rents payable prior to this period have been paid by the previous vendor or are payable by the tenant during the lease term.

8 Trade and other receivables

Group and Trust

2014

2013

$’000

$’000

Current assets

Trade receivables (gross)

2,308

1,641

Impairment losses

(1,197)

–

Trade receivables (net)

1,111

1,641

Deposits

3,373

604

Other receivables

1,717

2,409

Loans and receivables

6,201

4,654

Prepayments

4,701

2,500

Option fees paid

–

150

10,902

7,304

Non-current asset

Deposits

–

1,820

Total trade and other receivables

10,902

9,124

The Group’s primary exposure to credit risk arises through its trade and other receivables. The Group has a credit

policy in place and the exposure to credit risk is monitored on an ongoing basis.

Concentration of credit risk relating to trade receivables is limited due to the Group’s large number and diverse

range of tenants. The maximum exposure to credit risk for trade and other receivables is represented by the

carrying amount at the reporting date.

CAMBRIDGE INDUSTRIAL TRUST | A WINNING FORMULA

139