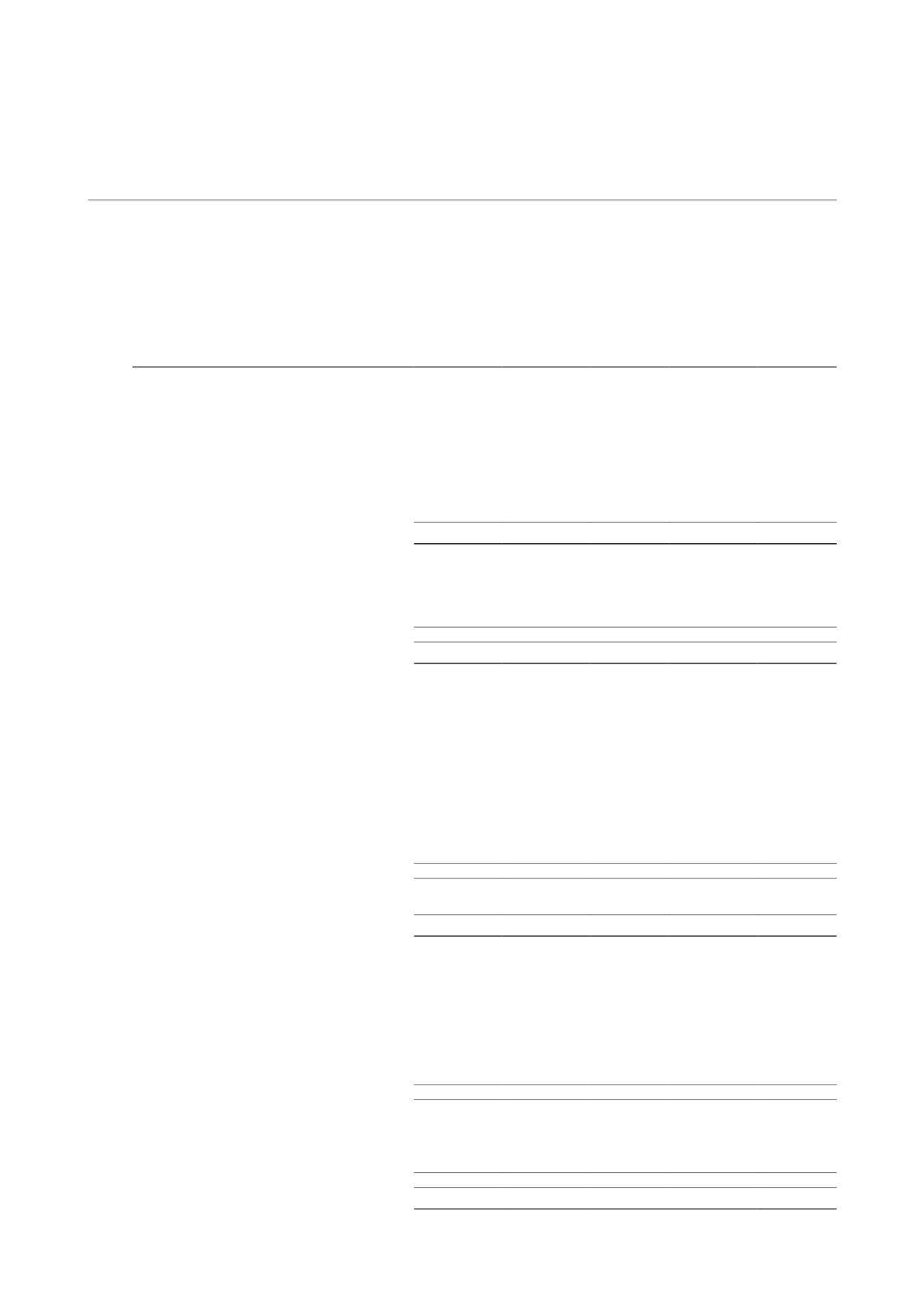

NOTES TO THE FINANCIAL STATEMENTS

10 Interest-bearing borrowings (Cont’d)

‹------------ Cash flow ------------›

Group

Gross

carrying

amount

Contractual

cash flows

Within

1 year

Within

1 to 5 years

More than

5 years

$’000

$’000 $’000

$’000 $’000

2013

Non-derivative financial liabilities

Club loan facility

– S$ floating rate loan (Facility A & B)

200,000 (212,910)

(4,479)

(208,431)

–

– S$ floating rate loan (Facility D)

12,172

(12,944)

(268)

(12,676)

–

Term loan facility/Acquisition term loan facility

– S$ floating rate loan

100,000 (106,618)

(1,633)

(104,985)

–

Medium Term Note

– S$ fixed rate note

50,000

(52,817)

(1,646)

(51,171)

–

Trade and other payables *

43,058

(43,058)

(31,072)

(11,986)

–

405,230 (428,347)

(39,098)

(389,249)

–

Derivative financial liability

Interest rate swaps

1,161

(969)

(969)

–

–

Derivative financial asset

Interest rate swaps

(227)

(2,429)

(572)

(1,857)

–

934

(3,398)

(1,541)

(1,857)

–

406,164 (431,745)

(40,639)

(391,106)

–

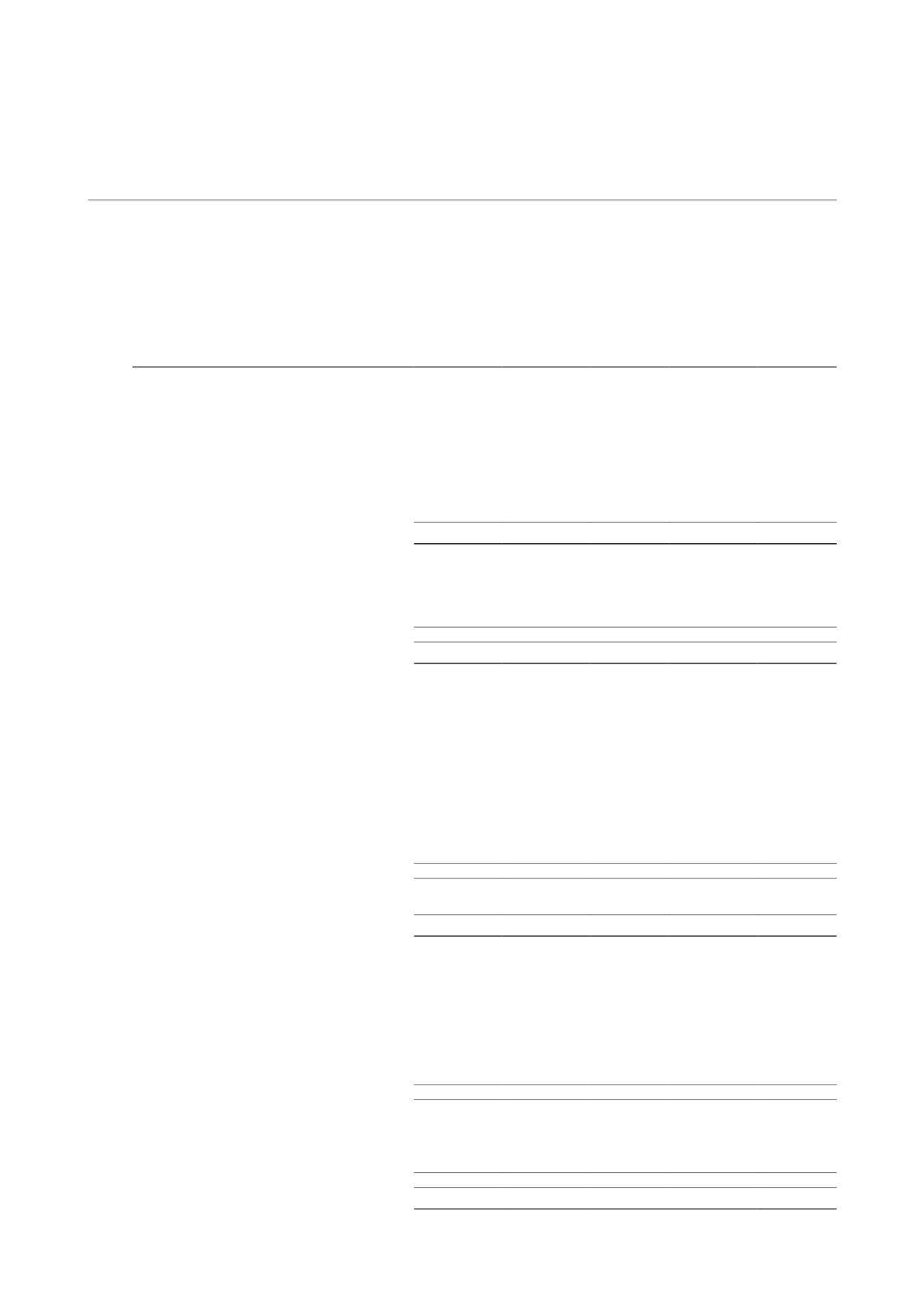

Trust

2014

Non-derivative financial liabilities

Club loan facility

– S$ floating rate loan (Facility A & B)

200,000 (209,031)

(6,341)

(202,690)

–

Term loan facility

– S$ floating rate loan

100,000 (105,868)

(2,065)

(103,803)

–

Loan from subsidiary

– S$ fixed rate note

50,000

(50,462)

(50,462)

–

–

– S$ fixed rate note

30,000

(36,554)

(1,014)

(4,923)

(30,617)

– S$ fixed rate note

100,000 (113,463)

(2,953)

(110,510)

–

Trade and other payables *

37,797

(37,797)

(25,499)

(12,298)

–

517,797

(553,175)

(88,334)

(434,224)

(30,617)

Derivative financial asset

Interest rate swaps

(287)

71

(71)

142

–

517,510 (553,104)

(88,405)

(434,082)

(30,617)

2013

Non-derivative financial liabilities

Club loan facility

– S$ floating rate loan (Facility A & B)

200,000 (212,910)

(4,479)

(208,431)

–

– S$ floating rate loan (Facility D)

12,172

(12,944)

(268)

(12,676)

–

Term loan facility/Acquisition term loan facility

– S$ floating rate loan

100,000 (106,618)

(1,633)

(104,985)

–

Loan from subsidiary

– S$ fixed rate note

50,000

(52,817)

(1,646)

(51,171)

–

Trade and other payables *

43,046

(43,046)

(31,060)

(11,986)

–

405,218 (428,335)

(39,086)

(389,249)

–

Derivative financial liability

Interest rate swaps

1,161

(969)

(969)

–

–

Derivative financial asset

Interest rate swaps

(227)

(2,429)

(572)

(1,857)

–

934

(3,398)

(1,541)

(1,857)

–

406,152

(431,733)

(40,627)

(391,106)

–

* Trade and other payables exclude rent received in advance.

CAMBRIDGE INDUSTRIAL TRUST | ANNUAL REPORT 2014

144