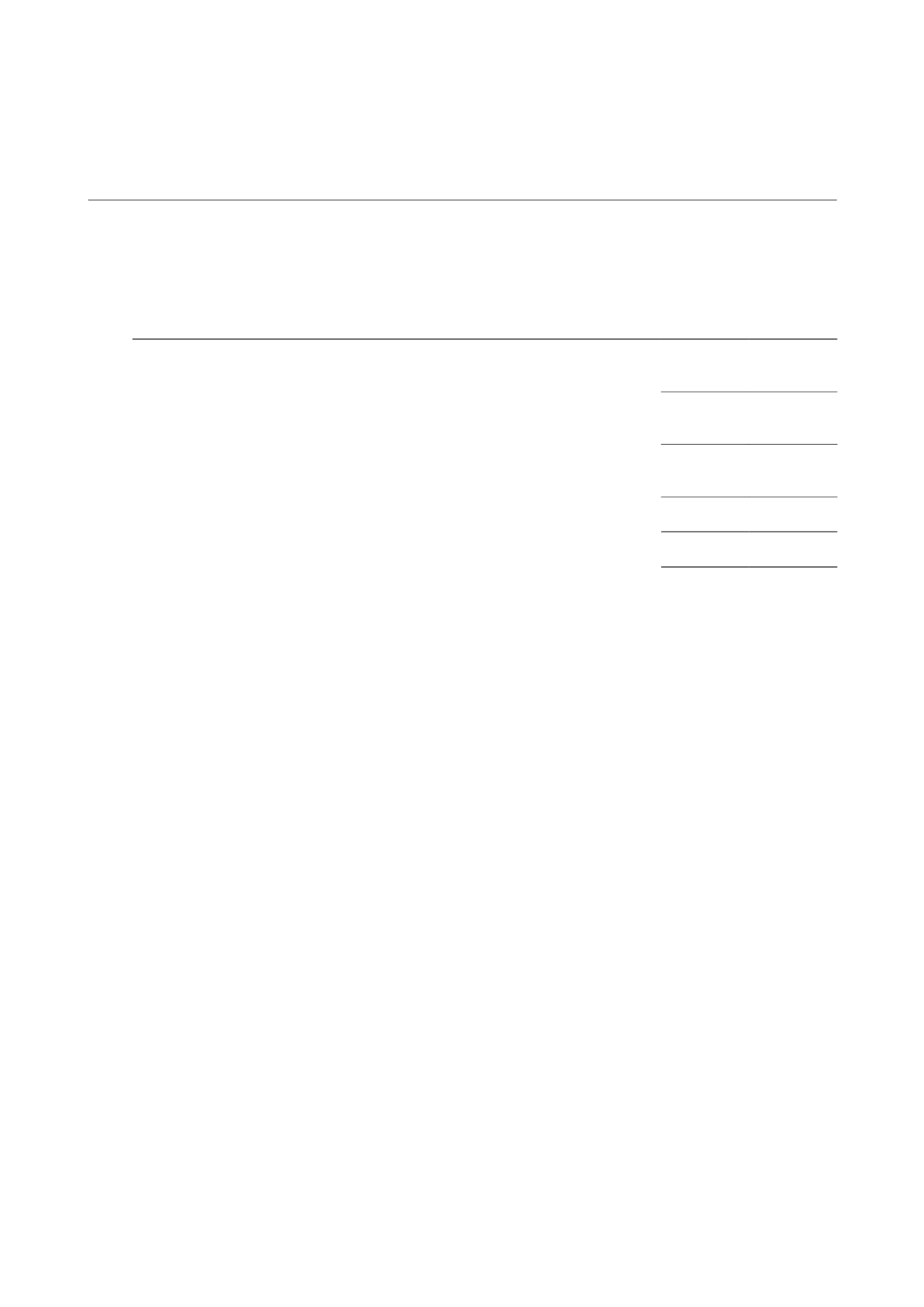

NOTES TO THE FINANCIAL STATEMENTS

11 Derivative financial instruments

Group and Trust

2014

2013

$’000

$’000

Non-current asset

Interest rate swaps

107

227

Current Asset

Interest rate swaps

180

–

Current liability

Interest rate swaps

–

(1,161)

Total derivative assets/(liabilities)

287

(934)

Derivative financial instruments as a percentage of net assets

0.03%

0.11%

Interest rate swaps

The Group manages its exposure to interest rate movements on its floating rate loans and borrowings by

entering into interest rate swaps. As at reporting date, the Group has interest rate swaps with a total notional

amount of $250.0 million (2013: $250.0 million) to provide fixed rate funding for approximately 2.1 years at a

weighted average effective interest rate of 0.73% (2013: 0.81%) per annum.

Offsetting financial assets and financial liabilities

The Group’s derivative transactions that are not transacted on an exchange are entered into under International

Swaps and Derivatives Association (ISDA) Master Netting Agreements. In general, under such agreements the

amounts owed by each counterparty that are due on a single day in respect of all transactions outstanding in

the same currency under the agreement are aggregated into a single net amount being payable by one party to

the other. In certain circumstances, for example when a credit event such as a default occurs, all outstanding

transactions under the agreement are terminated, the termination value is assessed and only a single net amount

is due or payable in settlement of all transactions.

The above ISDA agreements do not meet the criteria for offsetting in the statement of financial position. This is

because a right of set-off of recognised amounts is enforceable only following an event of default, insolvency or

bankruptcy of the Group and of the counterparties. In addition the Group and its counterparties do not intend

to settle on a net basis or to realise the assets and settle the liabilities simultaneously.

CAMBRIDGE INDUSTRIAL TRUST | A WINNING FORMULA

147