12 This refers to the difference between new space completed and space withdrawn.

Revised Guidelines for Supporting Uses in Industrial Development

Supporting Uses Current Policy

Revised Policy from

24 November 2014

Childcare Centres N.A.

All childcare centres within industrial

developments will be levied Civic &

Community Institution (“C&CI”) “E” rates.

Source: URA/MTI/Colliers International Singapore Research

3.0 SINGAPORE INDUSTRIAL PROPERTY MARKET OVERVIEW

3.1 EXISTING SUPPLY

Singapore had 461.2 million sq ft of completed industrial space as of 4Q 2014, 87.7% of which was owned by the

private sector and 12.3% by public agencies. Compared to 4Q 2013, the overall industrial stock has increased by

4.8% YoY, representing a net new supply

12

of 21.1 million sq ft in 2014.

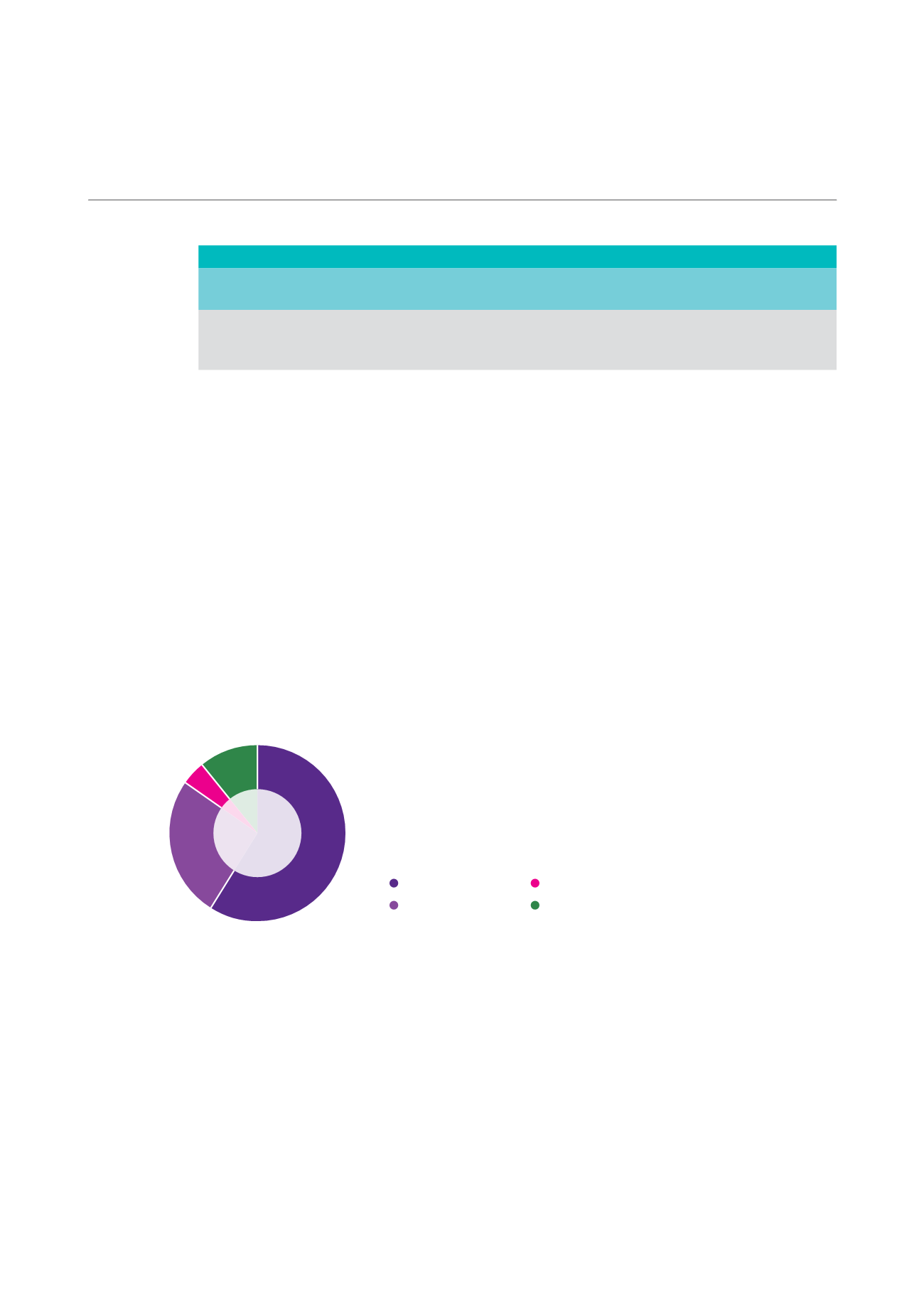

Single-user factory space accounted for the majority 53.2% (245.4 million sq ft) of the total islandwide industrial

stock as of 4Q 2014. Another 23.1% (106.4 million sq ft) and 19.6% (90.5 million sq ft) were multi-user factory and

warehouse spaces, respectively. Business park space constituted the remaining 4.1% (18.7 million sq ft).

BREAKDOWN OF TOTAL INDUSTRIAL PROPERTY STOCK

(AS OF 4Q 2014)

Single-User Factory

Business Park

Multi-User Factory

Warehouse

53.2%

23.1%

4.1%

19.6%

Total

Industrial

Stock 461.2

million sq ft

Source: JTC/Colliers International Singapore Research

3.2 GEOGRAPHICAL DISTRIBUTION OF ISLANDWIDE INDUSTRIAL PROPERTY STOCK

As of 4Q 2014, the West planning region held the majority 46.0% (212.1 million sq ft) of the islandwide industrial

stock, followed by the Central (19.1%), North (14.0%), East (13.5%) and Northeast (7.4%) planning regions.

CAMBRIDGE INDUSTRIAL TRUST | A WINNING FORMULA

81