SINGAPORE INDUSTRIAL PROPERTY MARKET OVERVIEW

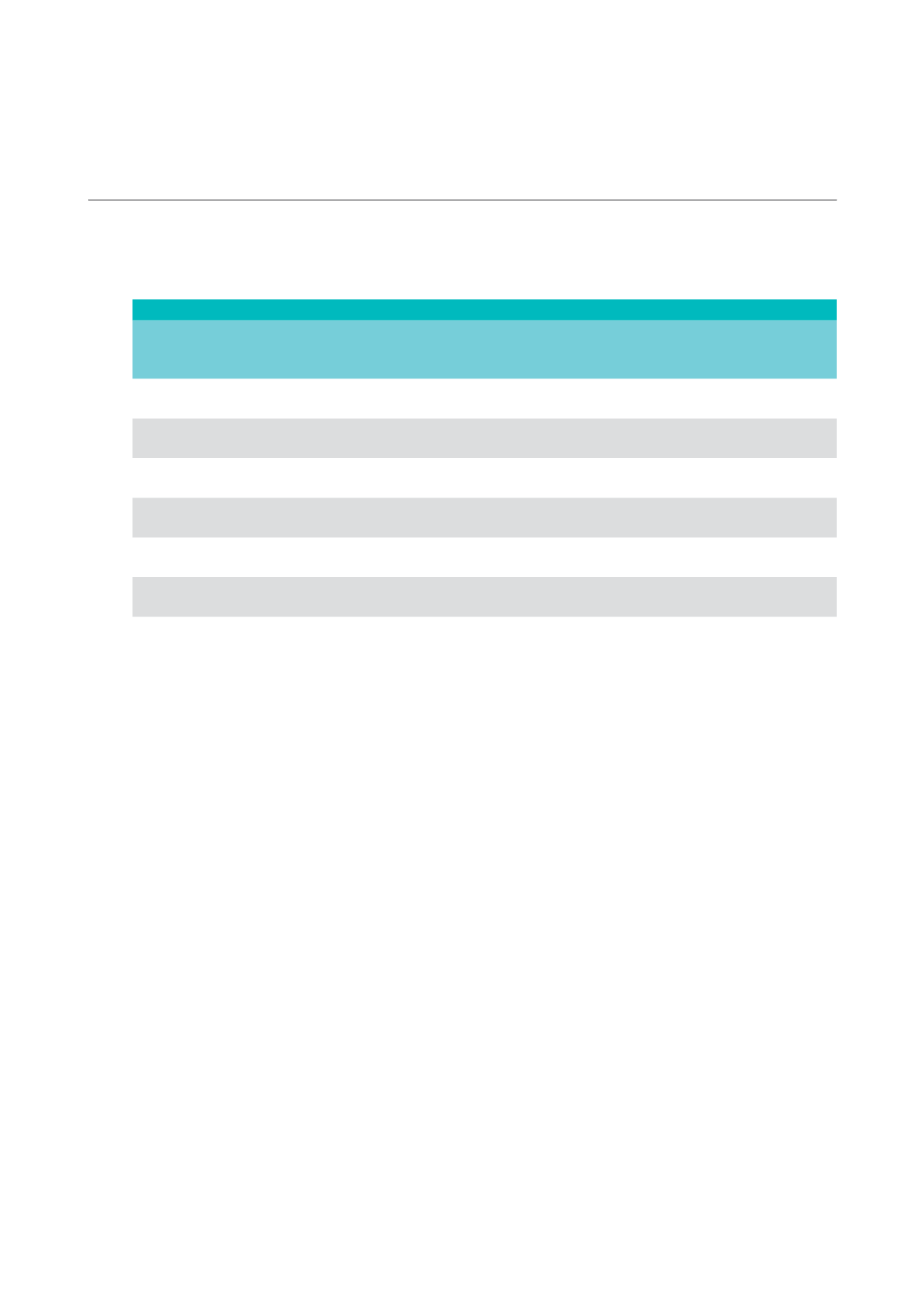

Some examples of major en-bloc factory acquisitions by institutional investors in 2014 are provided in the

following table.

Examples of Major Factory Investment Sales in 2014

Project Name

Location

Tenure

Estimated Net

Lettable Area

(sq ft)

Sale Price

(S$ million)

Price

(S$ per sq ft

over NLA)

2A Changi North

Street 2

2A Changi North

Street 2

30+30 years

w.e.f. 16 Aug 2011

67,844

(GFA)

$12.0

$177

(GFA)

39 Senoko Way 39 Senoko Way

30 years + 30 years

w.e.f. 16 Feb 1994

95,250

(GFA)

$18.0

$189

(GFA)

Lek Sun Building 12 Ang Mo Kio

Street 65

30 years

w.e.f. 16 Oct 1990

180,424

(GFA)

$39.8

$221

(GFA)

20 Kian Teck Lane 20 Kian Teck Lane 30 years + 20 years

w.e.f. 1 May 2000

93,767

(GFA)

$22.4

$239

(GFA)

Jackson Square 11 Lorong

3 Toa Payoh

60 years

w.e.f. 16 May 1969

355,265

$80.0

$225

Jackson Design

Hub

29 Tai Seng Street 30 + 30 years

w.e.f. 1 May 2007

85,070

$31.5

$370

Source: Colliers International Singapore Research

4.5 OUTLOOK

The outlook of the factory property segment is expected to be mixed in 2015. With industralists expected to

remain cost sensitive amid supply pressures, rents of multi-tenanted factory developments could experience

some downward pressures.

However, rents for factories with higher building specifications, such as those located within the business parks,

could see some upside potential due mainly to a tightening in supply.

Meanwhile, tenants with larger space needs (e.g. 100,000 sq ft and above) and who require space immediately

may face challenges finding available options. Apart from the limited availability of entire developments for

lease that also meet operational and technical requirements, there are also fewer options after JTC revised

its subletting policy with effect from 1 October 2014. The new policy requires end-user lessees to occupy

minimally 70% of their building compared to 50% previously, thereby leaving less space for subletting.

Over the same year, prices could ease on the back of the anticipated muted state of the strata-titled industrial sales

segment and continued effects of the TDSR requirement. Investment sales activity will continue to be affected by

the generally subdued market sentiment and recent JTC policy changes.

5.0 WAREHOUSE MARKET OVERVIEW

5.1 SUPPLY OF WAREHOUSE SPACE

5.1.1 EXISTING SUPPLY

As of 4Q 2014, the islandwide warehouse stock stood at 90.5 million sq ft, with the majority 98.9% privately owned and

the remaining 1.1% owned by the public sector.

CAMBRIDGE INDUSTRIAL TRUST | ANNUAL REPORT 2014

90