SINGAPORE INDUSTRIAL PROPERTY MARKET OVERVIEW

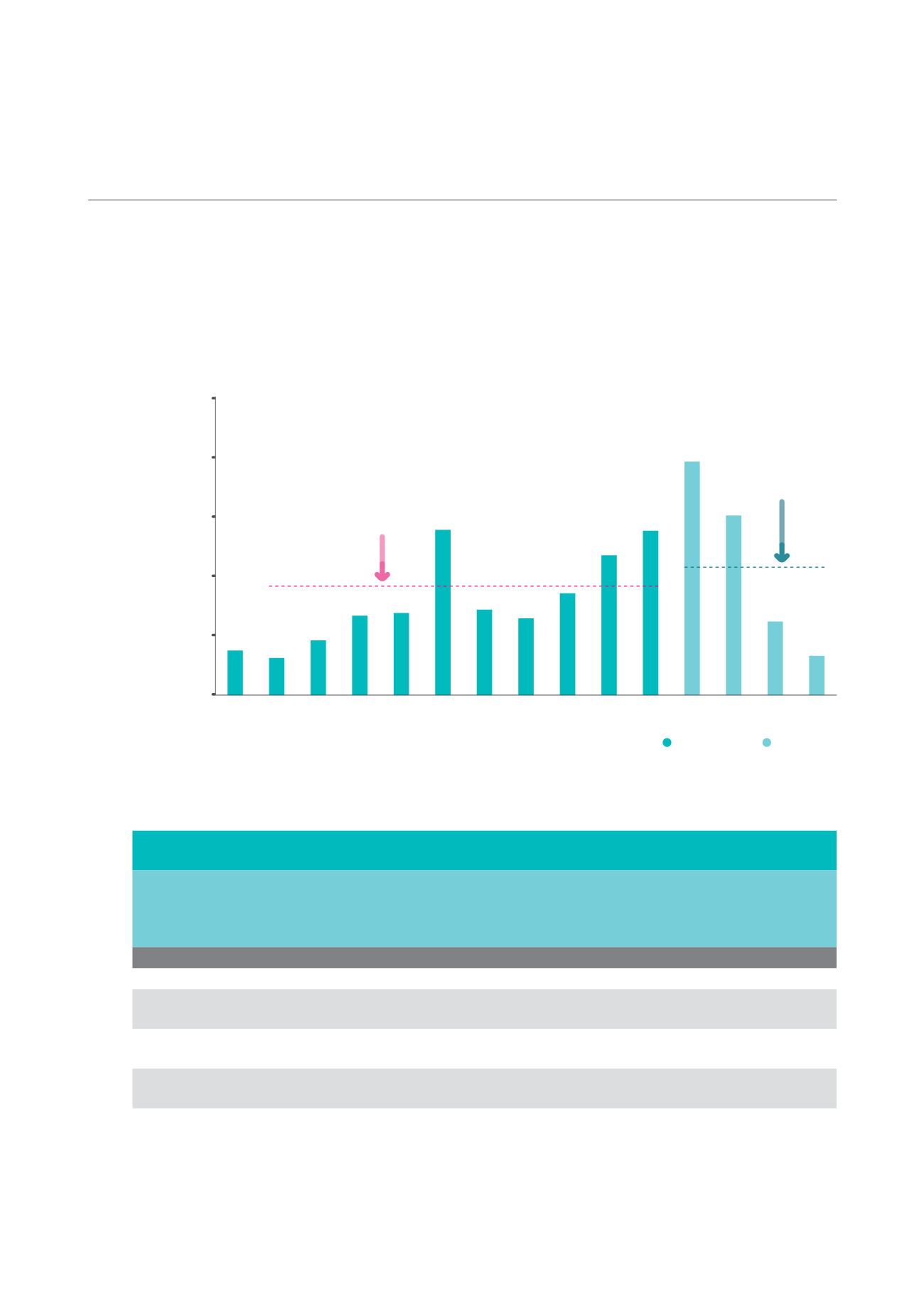

F: Forecast

Source: JTC/Colliers International Singapore Research

2004

2008

2006

2010

2012

2005

2009

2007

2011

2013 2014

2018F

2015F 2016F 2017F

25,000

20,000

15,000

10,000

5,000

0

Net Floor Area ('000 sq ft)

10-year Average Annual

Net New Supply of

8.3 million sq ft from

2005 to 2014

Average Annual

Potential New Supply

of 10.9 million sq ft

from 2015 to 2018

Completed

Upcoming

Examples of major upcoming factory developments by user-types are provided in the following table.

Examples of Major* Potential Supply of Factory (including Business Park) Space from 2015 to 2018

(As of 4Q 2014)

Project Name

Location

Developer

Estimated

Net Lettable

Area (sq ft)

Expected

Year of

Completion

(TOP)

Single-User Factory

Single-user Factory

Kaki Bukit Road 4

SEF Group Ltd

314,338

2015

Single-user Factory

Tuas South Avenue 5 Shell Eastern Petroleum

Pte Ltd

365,262

2015

A&A

Jurong Island

Exxonmobil Asia Pacific

Pte Ltd

319,553

2016

Awan Data Centre

1 Tuas Avenue 4

Awan Data Centre

Pte Ltd

333,460 2016

Indicatively, based on the published list of uncompleted projects by JTC as of 4Q 2014 and Colliers International’s

estimates, most (41.2%) of the total factory supply (including business park space) from 2015 to 2018 is expected

to be located in the West planning region, followed by the North (23.4%), Central (21.4%), East (7.6%) and

Northeast (6.3%) planning regions.

NET NEW AND POTENTIAL SUPPLY OF FACTORY (INCLUDING BUSINESS PARK) SPACE

(AS OF 4Q 2014)

continue on next page

CAMBRIDGE INDUSTRIAL TRUST | ANNUAL REPORT 2014

84